FreshBooks vs QuickBooks: 10 Key Factors To Look For Your Accounting Business

This blog is for you...

If you're drowning in accounting tasks and need a more efficient way to manage your finances.

Or

You’ve tried several accounting software options but still can’t decide between FreshBooks and QuickBooks.

In this FreshBooks vs QuickBooks guide, I’ll help you weigh the pros and cons of each, making it easier to decide which software fits your business needs better.

Two popular accounting software platforms that many businesses use.

I know it’s confusing.

Both promise to make your accounting easier, but it’s hard to tell which one is better.

But don’t worry:

There is one that might be just right for you. How do I know?

Because…

I went through many user reviews of both Freshbooks and QuickBooks on G2 and Capterra.

And I can help you with which one might be better for you and why.

Want to know more? Here’s what we’ll look at:

🌟 First, we’ll talk about what FreshBooks can do and why you might like it.

🌟 We'll look at what’s good about FreshBooks and what’s not so good.

🌟 And how much does FreshBooks cost? We’ll check that too.

🌟 Next, we’ll see what QuickBooks offers.

🌟 We’ll go through the benefits of using QuickBooks.

🌟 But QuickBooks isn’t perfect either. We’ll explore its downsides.

🌟 We'll also find out how much QuickBooks costs.

🌟 Can’t decide between them? We’ll compare them directly to see which one is easier to use and better value for money.

🌟 And, we’ll consider: Is there something else you should think about?

🌟 At the end, we’ll help you decide which one you should pick to make handling your business money much easier.

If you don’t have much time, you can skip to the last part.

But for the best advice, try to read the whole article.

So, make yourself a cup of tea, get comfortable, and let’s begin!

FreshBooks vs QuickBooks In a nutshell

Let's talk about FreshBooks first.

FreshBooks is an online accounting software that is great for freelancers, small businesses, and self-employed people.

It helps you with invoicing, tracking expenses, managing your time, and generating financial reports.

The best part is that it's very easy to use. Even if you're not great with numbers, FreshBooks makes managing your money simple and straightforward.

It's a good choice if you want something simple and don't need a lot of extra features.

Now, let's look at QuickBooks.

QuickBooks has been around for a long time and is very popular among small business owners.

It’s known for having a lot of features and being able to work with almost any other software you might use.

QuickBooks is available in both desktop and online versions, and it can be used by businesses of all sizes, from one-person operations to larger companies.

It helps with invoicing, tracking expenses, managing payroll, and more.

If you need a powerful tool that can grow with your business and handle complex financial tasks, QuickBooks is a great choice.

So, which one is better for you?

It depends on what you need. If you want something simple and easy to use, go with FreshBooks.

If you need a more advanced tool that can do a lot more, QuickBooks might be the better option.

Now that we've an overview on FreshBooks and QuickBooks, let's start with Freshbooks first and take a look at it more closely. Let’s start with the pros and cons of using FreshBooks.

What users likes and dislike about FreshBooks?

Here are the features of FreshBooks which users likes and dislikes the most:

FreshBooks Pros

Ease of Use:

- FreshBooks is really easy to use. Even if you're just starting out, you'll find it straightforward to get around the software.

- It has a cool feature where you can track your time and then turn that directly into invoices, making everything much smoother.

Functionality:

- Many users really like the proposal writing feature in FreshBooks. They say it's even better than what some other tools, like QuickBooks, offer.

- The software puts time management and accounting all in one place, so you have everything you need to handle your business tasks.

Customization:

- You can make your invoices look just like you want them to, even matching your business colours. This can make your business look more professional.

- There's also a handy option to keep all your client information in one spot, so you can reach it quickly when you need it.

Automation:

- FreshBooks has some automation features that, when they work right, can save you a lot of time. For example, it can create invoices for you automatically from your time tracking. This means less work for you and fewer chances to make mistakes.

FreshBooks Cons:

Lack of Development and Responsiveness:

- FreshBooks isn't updating with new features as often as you’d like. Also, if you send feedback or report an issue, it might take a while for them to respond or make changes.

- This can be frustrating, especially if you’re dealing with ongoing issues that affect your work.

Glitches and Bugs:

- You could encounter some glitches, like seeing incorrect account balances on your invoices or having trouble with the account statement feature.

- The mobile app, in particular, might crash often, which can be annoying if you rely on it to manage your finances on the go.

Customer Support Decline:

- You might experience slower response times from customer support compared to before. Sometimes, the help they offer might not solve your problems.

- It can be tough to get timely assistance, which can be quite inconvenient when you’re trying to resolve pressing issues.

Cost and Pricing Transparency:

- FreshBooks has raised its prices, and you might feel that the enhancements don’t quite match up with the cost increase.

- The pricing structure might seem a bit unclear, with some hidden fees that you weren’t expecting.

Integration and Compatibility Issues:

- If you’re using the classic platform, you might be disappointed to find there’s no integration with some other popular accounting software you use.

- Reconnecting payment processors and bank accounts can be troublesome, adding more tasks to your plate.

Manual Work:

- Despite claims of automation, you might still need to do quite a bit of manual work to ensure everything in your accounts is accurate.

- The system doesn’t automatically sum up different categories, so you’ll find yourself doing more manual calculations than you might have expected.

Now that we’ve looked at FreshBooks, let’s shift our focus to QuickBooks and explore its advantages and disadvantages to help you make a well-rounded decision.

How much does FreshBooks cost?

FreshBooks offers several pricing plans with various features and add-ons, tailored to meet different business needs. Here's a breakdown of the pricing for each plan:

- Lite Plan

- Price: $7.60/month for the first 4 months, then $19.00/month.

- Features: Up to 5 clients, unlimited invoices, expenses, estimates, and payments via credit cards and bank transfers (ACH).

- Add-ons: Team Members at $11 per user per month, Advanced Payments at $20 per month, and FreshBooks Payroll (price varies).

- Plus Plan (Most Popular)

- Price: $13.20/month for the first 4 months, then $33.00/month.

- Features: Everything in Lite, plus up to 50 clients, proposals, automated bill capture, collaboration tools, and financial reporting.

- Add-ons: Same as Lite, including team members at $11 per user per month, Advanced Payments at $20 per month, and FreshBooks Payroll.

- Premium Plan

- Price: $24.00/month for the first 4 months, then $60.00/month.

- Features: Everything in Plus, and service to an unlimited number of clients, project profitability tracking, accounts payable, and more.

- Add-ons: Same as Plus, but Advanced Payments are included.

- Select Plan

- Price: Custom pricing (need to contact for details).

- Features: Everything in Premium, plus lower transaction fees, custom onboarding, two team member accounts included, and more.

- Add-ons: Advanced Payments included, team members at $11 per user per month, and FreshBooks Payroll.

All plans offer a 30-day money-back guarantee, and there are promotional discounts of 60% off for the first four months.

The plans also allow various degrees of customization and access to additional features such as payroll and advanced payment options, tailored to suit different sizes and types of businesses.

Let’s know about Quickbooks now.

What Users like and dislike about QuickBooks?

Here are the features of QuickBooks which users likes and dislikes the most:

QuickBooks Pros:

Ease of Use and Accessibility:

- QuickBooks Online is user-friendly and easy to navigate, which is great even if you're new to accounting.

- You can access it from any device as long as you have an internet connection, which means you can work from anywhere, anytime.

Recurring Billing:

- The recurring billing feature doesn’t cost extra. This is a nice saving compared to other services like PayPal.

Integration and Collaboration:

- QuickBooks Online works well with other services like EDD, payroll, and insurance agencies. This can really help streamline your business operations.

- It also allows multiple users to access the data at the same time, which is great for teamwork.

Automation and Tracking:

- The software automates several tasks like mileage tracking, business expense tracking, and calculating quarterly taxes, which can save you a lot of time.

- Everything is backed up automatically and stays synced across all your devices.

Reporting and Customization:

- You can customise reports and save them, which makes managing your finances easier.

- QuickBooks provides detailed insights into your financials, helping you make smarter business decisions.

Support and Assistance:

- Historically, QuickBooks has had good customer support, with specialists ready to help you solve any issues.

QuickBooks Cons:

Feature Limitations:

- Some features you find in the online version are not available in the desktop version, which might limit what you can do if you use the desktop version.

Pricing and Transparency:

- The pricing structure can be a bit confusing, and sometimes it feels like there are hidden costs that weren't clearly explained upfront.

- Some users have noticed prices going up unexpectedly, which can be quite frustrating.

Multi-Currency and Language Support:

- If you deal with international transactions, you might find the multi-currency support lacking.

- There’s also limited support for different languages, which might be a problem if you manage accounts in more than one language.

How much does QuickBooks cost?

QuickBooks offers a range of plans for both their Online and Desktop Enterprise versions, each designed to cater to different business needs. Here’s a detailed look at the pricing for both:

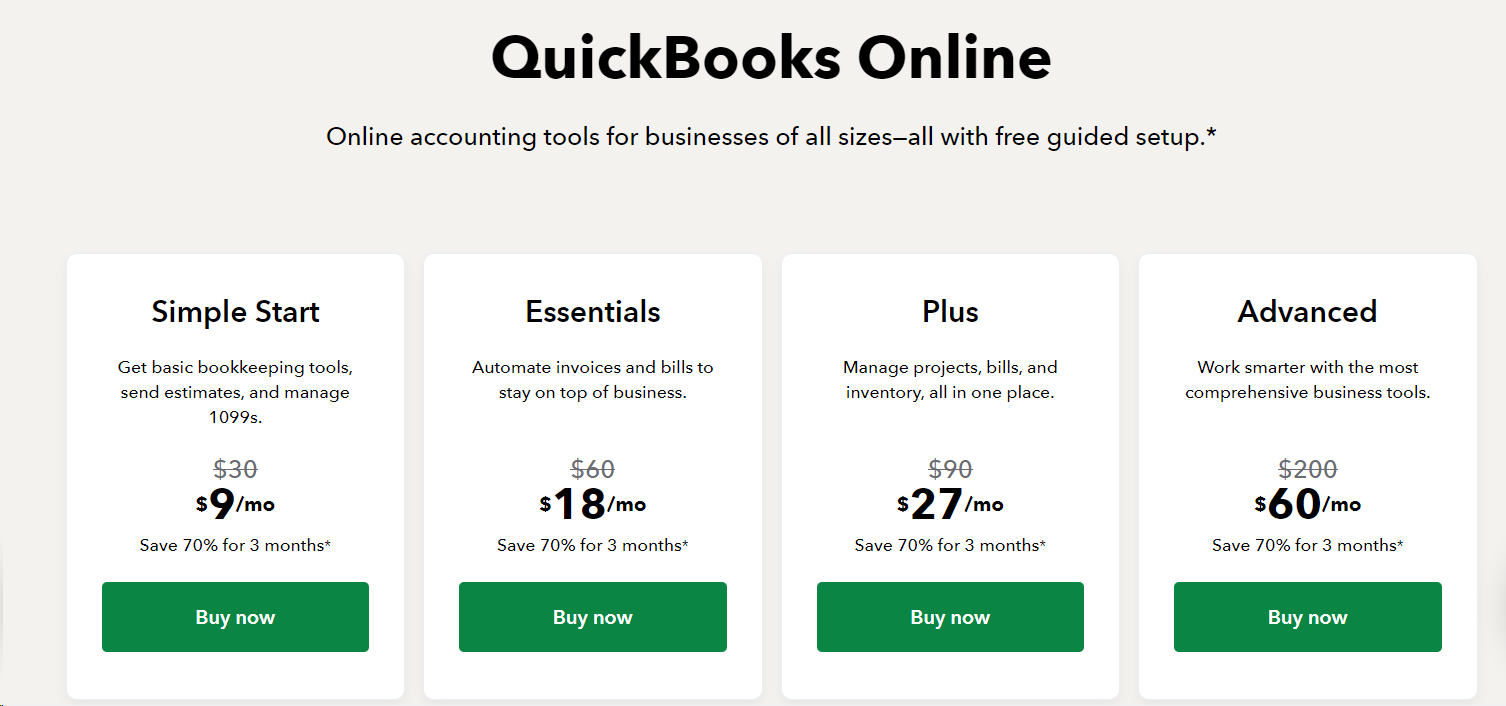

QuickBooks Online

- Simple Start

- Price: $30 per month, discounted to $9 per month for the first 3 months (Save 70%).

- Features: Basic bookkeeping tools, send estimates, manage 1099s.

- Ideal For: Small businesses needing essential accounting features.

- Essentials

- Price: $60 per month, discounted to $18 per month for the first 3 months (Save 70%).

- Features: Automation of invoices and bills.

- Ideal For: Businesses that need more automation for billing and invoicing.

- Plus

- Price: $90 per month, discounted to $27 per month for the first 3 months (Save 70%).

- Features: Manage projects, bills, and inventory.

- Ideal For: Businesses needing comprehensive tools for project and inventory management.

- Advanced

- Price: $200 per month, discounted to $60 per month for the first 3 months (Save 70%).

- Features: Access to the most comprehensive business tools.

- Ideal For: Larger businesses needing advanced features and functionality.

QuickBooks Desktop Enterprise

- Gold Plan

- Price: $1922 for the first year.

- Features: Supports up to 30 users, advanced reporting, QuickBooks Priority Circle, enhanced payroll.

- Subscription: Annual.

- Platinum Plan

- Price: $2363 for the first year.

- Features: All features of the Gold Plan, plus advanced inventory, advanced pricing, bill & PO workflow approvals.

- Subscription: Annual.

- Diamond Plan

- Price: $4668 for the first year.

- Features: All features of the Platinum Plan, plus supports up to 40 users, assisted payroll, QuickBooks Time Elite, optional Salesforce CRM connector.

- Subscription: Monthly.

Each version of QuickBooks offers different levels of functionality tailored to varying business sizes and needs, from basic bookkeeping to advanced enterprise management.

FreshBooks vs QuickBooks: In-depth comparison

Having explored the pros and cons of QuickBooks, let's dive deeper with an in-depth comparison between FreshBooks and QuickBooks, starting with a detailed look at the differences between QuickBooks Online and QuickBooks Desktop.

This will help you understand which version might better suit your needs before comparing both tools head-to-head.

QuickBooks Online vs. QuickBooks Desktop

Let's compare two popular versions of QuickBooks: QuickBooks Online and QuickBooks Desktop.

Understanding the differences can help you choose the right one for your business. Let's break it down into simple terms:

Accessibility

- QuickBooks Online: You can use it from anywhere! Just need an internet connection and you can log in from any device like your phone, laptop, or tablet. Great for when you're moving around or working with others remotely.

- QuickBooks Desktop: You need to be at the computer where it's installed to use it. If you want to access it from somewhere else, you’ll have to pay extra.

Flexibility

- QuickBooks Online: You can choose a plan that lets 5 or even 25 people use the system, depending on how big your team is. Need more? You can add extra users, but it costs more.

- QuickBooks Desktop: The number of users is limited by the plan you buy. Adding more users also means extra fees.

Automation and Mobile Support

- QuickBooks Online: Makes life easier by automating regular tasks, creating reports by itself, and connecting directly to your bank. There’s also a handy mobile app so you can keep working even when you’re not at your desk.

- QuickBooks Desktop: It’s a bit behind on automation and the mobile app doesn’t do as much, which could be a drawback if you need to work while you’re away from the office.

Security and Integration

- QuickBooks Online: Keeps your data safe with automatic updates and backups. Plus, it can connect with over 750 other apps, making it easier to work with tools you already use like Shopify or PayPal.

- QuickBooks Desktop: You have to manage your own backups and updates, which can be a bit of work. It also connects with fewer apps, so it might not fit as smoothly into your workflow.

Additional Features

- QuickBooks Online: You can get extra help by hiring QuickBooks-certified bookkeepers. It also offers tools for managing things like employee benefits and time tracking automatically.

- QuickBooks Desktop: Doesn’t offer as much here—you can’t hire certified bookkeepers through it, and it has fewer options for employee benefits and manual time tracking.

So, what does this all mean for you? If you love the idea of being able to work from anywhere and want lots of handy features, QuickBooks Online might be the way to go.

But if you’re okay with working from one location and handling some of the tech stuff yourself, QuickBooks Desktop could still be a good choice.

Think about what fits best with how you work and what you need for your business!

Now that we've looked at the differences between QuickBooks Online and Desktop, let's dive deeper into how FreshBooks compares to both. This will help you see which one might be the best fit for your business.

In Depth Comparison: FreshBooks vs. QuickBooks Online and Desktop

Overview:

FreshBooks: Simple and User-Friendly

Firstly, FreshBooks is a great tool if you're just starting out or if you run a small business or freelance. People love how easy it is to use. You won't need to be an expert in finance to understand how to manage your invoicing and track your expenses here.

- Pros: Users really appreciate that FreshBooks is simple to navigate. It has some neat features, like turning the time you've tracked on tasks directly into invoices—this can be super handy!

- Cons: However, some users find that FreshBooks doesn't roll out new features very quickly. Also, if you run into problems, getting help might take a bit longer than you'd like.

QuickBooks: Comprehensive and Scalable

Now, let's talk about QuickBooks. This software is a favourite among many small to medium-sized business owners because it offers a lot of features and can integrate well with other systems you might be using.

- Pros: QuickBooks is known for its robustness. It can do a lot—from managing payroll to generating detailed financial reports. Plus, it’s available both online and as desktop software. This means you can pick what works best for your business.

- Cons: On the downside, some features you might need are only available in the online version or the desktop version, not both. Also, the pricing can get a bit confusing and might feel like it's hidden with extra costs.

Pricing Details

Talking about costs, knowing what each software charges is crucial:

FreshBooks Pricing

- Lite Plan: Starts at $7.60 per month, good for freelancers or very small teams.

- Plus Plan: At $13.20 per month, this plan lets you handle more clients and includes features like project proposals.

- Premium Plan: For $24.00 per month, you get to work with an unlimited number of clients and access advanced features.

FreshBooks is quite affordable, especially with the discounts for the first few months, making it a budget-friendly option for those just starting out.

QuickBooks Online Pricing

- Simple Start: $30 per month, with a big discount for the first three months ($9 per month).

- Essentials: $60 per month, also discounted at the start, helps automate more of your business operations.

- Plus and Advanced Plans: These are priced at $90 and $200 per month, respectively, offering extensive management tools for larger businesses.

Features: What Can FreshBooks and QuickBooks Do For You?

- FreshBooks is really great if you want something that isn't too complex. It helps you manage invoices, track time, and handle your expenses pretty easily. It’s especially good for freelancers or smaller businesses who need a straightforward tool.

- QuickBooks offers a lot more in terms of features. Besides the basics like invoicing and expense tracking, it also handles things like payroll and advanced financial reporting. This makes it suitable for businesses that are growing or have more complex needs.

Scalability: Will They Grow With Your Business?

- FreshBooks is perfect for smaller operations. It’s easy to get started with and good at what it does, but if your business starts getting a lot bigger, you might find it a bit limiting because it doesn't have as many advanced features.

- QuickBooks, on the other hand, is built to grow with your business. With its range of plans and robust features, it can accommodate everything from a solo operation to a large company. This makes it a more scalable option if you expect your business to expand and evolve.

Customer Support: Getting the Help You Need

- FreshBooks has a friendly support team, but some users feel that it takes a while to get responses and that the updates and fixes are not as frequent as they would like. This could be a bit frustrating if you encounter issues that affect your daily operations.

- QuickBooks generally has a good reputation for customer support, with specialists ready to assist you. However, some users have mentioned that resolving more complex issues can be a bit tricky and sometimes there are additional costs involved if you need very specific help.

Integration: Working With Other Tools

- FreshBooks offers basic integration capabilities with other software, which can be sufficient for simpler business setups. However, if you're using a lot of different tools, you might find it lacks the ability to integrate smoothly with all of them.

- QuickBooks shines in this area. It can integrate with over 750 different apps. This is a huge advantage if you rely on various other tools for e-commerce, customer relationship management, or other aspects of your business operations.

Conclusion: How QuickBooks Online is Better than FreshBooks?

QuickBooks Online stands out as the superior choice due to its comprehensive feature set, robust automation capabilities, and flexible access.

While FreshBooks may offer a simpler interface, it falls short in terms of development, automation, and advanced functionalities.

QuickBooks Online's competitive pricing, extensive integrations, and reliable customer support make it a more effective and efficient solution for small to mid-sized businesses looking for a complete accounting platform.

QuickBooks Desktop remains a solid choice for users needing detailed, robust accounting features without the need for online access but lacks the flexibility and modern features of QuickBooks Online.

Having explored how FreshBooks and QuickBooks stack up against each other, let's shift our focus to another exciting aspect: discovering how QuickBooks can enhance its capabilities by integrating with Xenett, an accounting management software, to deliver even greater benefits for your business.

How Quickbooks do wonders with Xenett - A financial close software?

Before we go any further, let me tell you about Xenett and why I think it's a great match with QuickBooks. You might be wondering what Xenett is and why I’m suggesting you use it alongside QuickBooks. Well, let’s clear that up!

What is Xenett?

Think of Xenett as a helper for your QuickBooks Online (QBO). It's a software that manages your accounting workflow and financial closing tasks. ‘

It’s designed to work perfectly with QuickBooks, acting like a smart add-on that hooks right into your QBO account.

This makes everything about managing your finances smoother and more streamlined.

What’s New in Xenett 2.0?

With the latest update, Xenett 2.0, there are some new features and improvements that make it even better at working with QuickBooks. Let’s get into how Xenett really boosts what you can do with QuickBooks, making your accounting tasks easier than ever.

Why Use Xenett with QBO?

Here are the benefits of using Xenett with Quickbooks:

Enhanced Accuracy

First off, Xenett is like having an extra set of eyes that never gets tired. It automatically scans your QBO data for any errors or things that just don't look right.

This means fewer mistakes and more accurate financials, which is super important, right?

Catching these errors early helps keep your books clean and avoids bigger headaches later.

Simplified Workflow

Smart Search Feature - Xenett - YouTube

Think about the time you spend on repetitive tasks—like sorting transactions or hunting down missing details.

Xenett takes care of that for you.

It automates these tasks, so you don't have to, freeing up your time so you can focus on the more important parts of your business.

Improved Collaboration

If you're working with a team, especially in accounting or bookkeeping, Xenett makes communicating so much easier.

You can quickly point out any discrepancies or missing bits of information directly within QBO for your team or clients to see and fix.

This really smooths out the workflow and keeps everyone on the same page.

Faster Month-End Close

Closing your books at the end of the month can be stressful and time-consuming. Here’s where Xenett steps in—speeding up the process by automating everything.

This can really cut down on your stress and give you time back for other tasks or even some well-deserved rest.

Key Benefits of Using Xenett

- Reduced Errors: With its automated error detection, Xenett helps ensure your financial records are spot on, increasing reliability.

- Saved Time: By automating tasks and simplifying your workflow, it frees up your time for other priorities, boosting your overall efficiency.

- Faster Financial Close: The month-end close becomes quicker and more efficient with Xenett, which is always a big plus.

How Xenett Addresses QuickBooks Cons

- Glitches and Bugs: Xenett’s eagle-eye for errors helps catch and fix glitches in your QBO data, which means fewer bugs and smoother operation.

- Manual Work: With Xenett doing a lot of the heavy lifting by automating repetitive tasks, there’s less manual work for you, making QuickBooks even more efficient.

- Support Quality: Because Xenett improves accuracy and reduces the need for constant checks, you’ll likely face fewer issues, which means less time dealing with support and more time growing your business.

- Integration Challenges: Xenett fits into QBO like a glove, enhancing what QuickBooks can do and filling in the gaps where QuickBooks might need a little help.

So, if you're looking for a way to make your accounting tasks easier, more accurate, and more efficient, adding Xenett to your QuickBooks Online could be a smart move!

Final Say!

That’s all!!!

🤓But Let's have some fun while we wrap up our chat about two popular pals in the accounting software world: FreshBooks and QuickBooks.

Quick Quiz Time:

- Who’s the easy-going buddy, great for freelancers and small business owners who like things simple and straightforward? Yep, it's FreshBooks!

- And who’s the robust friend with lots of tools and tricks, ready to grow with your business and handle more complex stuff? You got it—QuickBooks!

Choosing the right software might seem like a big task, but it really comes down to what you need right now and what you think you'll need as your business grows.

If you like things easy and light, FreshBooks might just be your new best friend.

But if you're planning big things and need a tool that can keep up, QuickBooks could be the way to go.

And, guess what? There’s a bonus round!

Let's add a dash of magic with Xenett, the super-helper that makes QuickBooks even more awesome.

Think of Xenett like the buddy who comes in and makes sure everything runs super smoothly—fewer errors, less manual work, and more time for you to focus on the fun parts of your business.

Why pair QuickBooks with Xenett?

- It’s like having a superpower that checks your work for mistakes—so less worry for you.

- It saves you a bunch of time by automating the boring stuff.

- It makes working with your team or your accountant a breeze, so everyone’s on the same page.

Final Fun Challenge: Ready to make your accounting tasks easier and more fun? Why not give QuickBooks and Xenett a spin? Click here to try them out! See how they can work wonders for you. Go on, it’s just a click away!

So, what are you waiting for? Check in and see how these tools can make handling your business money feel like a piece of cake. Yum! 🍰

.svg)