QuickBooks Alternatives: Top 3 Picks For Accountants

Are you searching for QuickBooks alternatives because it's too common and doesn't fit your needs?

Let's explore the top 3 QuickBooks alternatives that can make your accounting easier and better!

- Xero

- Freshbooks

- Zoho Books

I know QuickBooks is powerful, but sometimes it can feel too complicated.

Whether it's the cost, complexity, or integration issues, finding the right software can make a big difference.

Here’s what you need to know: Using software that doesn't match your business needs can slow you down and cause problems.

The simple solution?

Look at other accounting software options that fit your needs better.

What should you look for in a QuickBooks alternative?

🔥 Easy-to-use interfaces that make accounting simple,

🔥 Strong invoicing and expense tracking features,

🔥 Good integration with other tools you use, and

🔥 Affordable plans that fit your budget.

And what’s really important in accounting software?

Wait for it…

Finding the right fit for your business!

Got it? Great!

So today, let's explore:

👉 The top 3 QuickBooks alternatives that can make your accounting tasks easier,

👉 How these tools compare in features, usability, and pricing,

👉 Key benefits of switching to each alternative, and

👉 Tips on choosing the best software for your needs.

If you're searching for QuickBooks alternatives because of the manual financial closing process, you can automate and save tons of time using Xenett. It lets you automate and create error-free books on QuickBooks.

Ready to find the perfect accounting solution for your business? Let’s get started!

What is QuickBooks?

QuickBooks is a powerful accounting software made by Intuit. It helps businesses manage their finances easily.

With QuickBooks, you can handle bookkeeping, invoicing, payroll, and expense tracking. It makes accounting tasks simple, so you can manage your business finances better.

Here are the Two Versions of QuickBooks: QuickBooks Online and QuickBooks Desktop

QuickBooks comes in two main versions: QuickBooks Online and QuickBooks Desktop. Each version has its own features and benefits for different business needs.

QuickBooks Online

QuickBooks Online is a cloud-based version.

This means you can access your financial data from any device with the internet. It is easy to use, flexible, and works well with many other apps. Here are the key features:

- Access from any device with internet

- Automatic data backups and updates

- Work in real-time with multiple users

- Integrates with over 750 apps

- Automates tasks like invoicing and expense tracking

QuickBooks Desktop

QuickBooks Desktop is software you install on your computer. It offers more advanced features and customization options. This version is good for businesses that want a strong, on-premise solution. Key features include:

- Detailed and customizable financial reports

- Advanced inventory management

- Enhanced security with local data storage

- Network access for multiple users (depending on the plan)

- Comprehensive payroll management

By choosing the right version of QuickBooks, you can make managing your business finances much easier.

Now that we know what QuickBooks is and the different versions it offers, let's take a closer look at the advantages and disadvantages of using QuickBooks.

What are the advantages of using QuickBooks?

Here are the benefits of using QuickBooks:

- User-Friendly: Intuitive interface that simplifies accounting tasks for non-accountants.

- Time-Saving: Automates repetitive tasks such as invoicing, payroll, and bank reconciliation.

- Scalable: Offers solutions for various business sizes, from solo entrepreneurs to large enterprises.

- Cost-Effective: Reduces the need for extensive accounting staff or outsourcing.

- Real-Time Data: Provides up-to-date financial data for better decision-making.

- Compliance: Helps businesses stay compliant with tax regulations and reporting requirements.

What are the disadvantages of using QuickBooks?

Now, let's talk about some of the not-so-great things about using QuickBooks, both the Online and Desktop versions.

QuickBooks Online Cons

- Limited Features: If you need advanced accounting features, the Online version might not have everything you need.

- Higher Costs: If you want to add more users or get extra features, it can get pricey.

- Internet Dependence: You need a good internet connection to use it. No internet, no access.

- Sync Issues: Sometimes, it has trouble syncing with your bank or other apps, which can be annoying.

QuickBooks Desktop Cons

- Limited Access: You have to install it on one computer. This means you can't use it from just anywhere.

- Manual Backups: You need to remember to back up your data and update the software yourself.

- Higher Costs: It costs more upfront, and there are yearly fees to keep it updated.

- Limited Integration: It doesn't work with as many other apps as the Online version does.

If you're interested in finding out more about Quickbooks and what real users think of it, see my recent Quickbooks review guide where I demystified over 1000 real G2 and Capterra reviews for Quickbooks.

Knowing these drawbacks can help you decide which version of QuickBooks is best for you.

Let’s now know the pricing plans Quickbooks offer.

How Much Does QuickBooks Cost?

Here are the pricing plans of both the versions of Quickbooks:

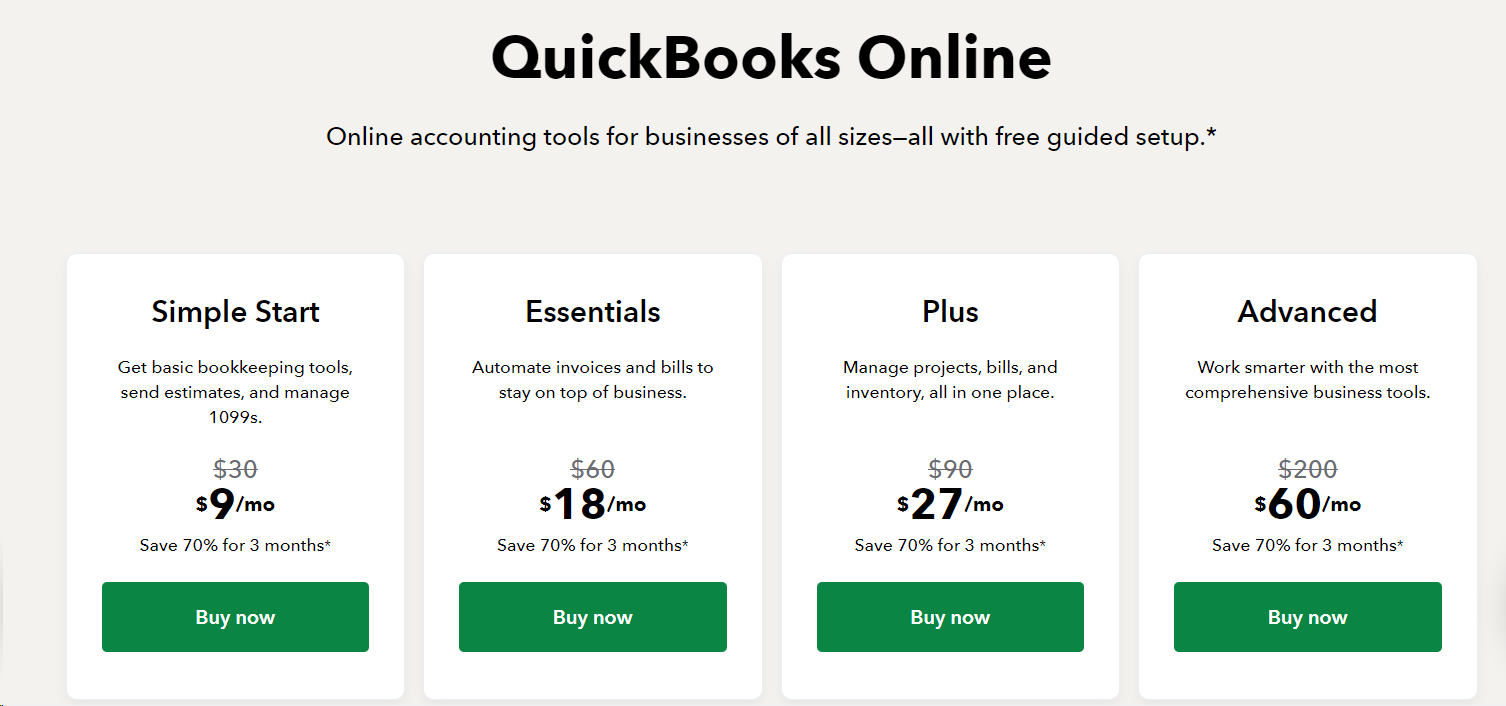

QuickBooks Online Pricing

Let's look at the prices for QuickBooks Online. Here are the different plans you can choose from:

- Simple Start: $30/month (but only $9/month for the first 3 months) - This plan gives you basic bookkeeping tools.

- Essentials: $60/month (but only $18/month for the first 3 months) - This plan adds features to help you automate invoices and bills.

- Plus: $90/month (but only $27/month for the first 3 months) - With this plan, you can manage projects, bills, and inventory.

- Advanced: $200/month (but only $60/month for the first 3 months) - This plan has all the tools you need for larger businesses.

QuickBooks Desktop Pricing

Now, let's check out the prices for QuickBooks Desktop. Here are the plans available:

- Gold Plan: $1922/year - This includes advanced reporting, enhanced payroll, and support for up to 30 users.

- Platinum Plan: $2363/year - You get everything in the Gold Plan, plus advanced inventory and pricing features.

- Diamond Plan: $4668/year - This plan supports up to 40 users, includes assisted payroll, QuickBooks Time Elite, and an optional Salesforce CRM connector.

Alright, now that we know the costs, let's look at why you might want to think about other options besides QuickBooks.

Reasons to go for QuickBooks alternatives

While QuickBooks is a strong option, you might want to look at other choices for a few reasons:

Cost

QuickBooks can be pricey, especially if you run a small accounting firm or work as a solo accountant.

Complexity

It has a lot of features, which can be too much if you only need simple accounting.

Integration Issues

Not all businesses find that QuickBooks works well with their other apps and systems.

Customer Support

Some people say that QuickBooks' customer support can be slow and not very helpful.

Thinking about these points can help you decide if QuickBooks is the best choice for you, or if you should explore other options.

Here's a comparison table to give you an idea of what I'll be discussing.

#1 QuickBooks alternative - Xero

Let's talk about Xero, a top alternative to QuickBooks.

Xero is cloud-based accounting software made for small to medium-sized businesses.

It helps you with things like invoicing, paying bills, reconciling bank accounts, tracking expenses, and creating financial reports.

People like Xero because it's easy to use, connects with many apps, and is flexible.

Xero’s Pros:

- User-Friendly Interface: Xero is easy to use, even if you don't know much about accounting.

- Cloud Accessibility: Since it's cloud-based, you can access your account from any device with the internet.

- Automated Bank Feeds: Xero automatically imports and categorises your bank transactions, making reconciliation simple.

- Extensive Integrations: Xero works with over 800 apps, including popular ones like Shopify, Stripe, and PayPal.

- Real-Time Reporting: You get up-to-date financial reports and dashboards to see how your business is doing.

- 24/7 Support: You can get help anytime with Xero's round-the-clock online support.

- Scalability: Xero has different pricing plans that can grow with your business, offering more features as you need them.

Xero’s Cons:

- Learning Curve: Even though it's user-friendly, it can take some time to learn all of Xero's features.

- Limited Offline Access: Since it's cloud-based, you need an internet connection to use Xero.

- Limited Multi-Currency Support: Multi-currency support is only available in the Premium plan, which costs more.

- Customization Limitations: Some users find Xero's options for customising invoices and reports less flexible compared to other software.

How much does Xero Cost?

Let's look at how much Xero costs, especially with their current discount offer. If you buy Xero before 30 June, you can get 50% off your plan for up to 6 months.

Starter Plan

- Usually: $29 per month

- Now: $14.50 per month

- Save: $87 over 6 months

With the Starter plan, you can:

- Send quotes and up to 20 invoices

- Enter up to 5 bills

- Reconcile bank transactions

- Capture bills and receipts with Hubdoc

- Get short-term cash flow and business snapshot

- Bulk reconcile transactions

Standard Plan

- Usually: $46 per month

- Now: $23 per month

- Save: $138 over 6 months

With the Standard plan, you get all the features of the Starter plan but can send more invoices and enter more bills.

Premium Plan

- Usually: $62 per month

- Now: $31 per month

- Save: $186 over 6 months

With the Premium plan, you get all the features of the Standard plan plus:

- Use multiple currencies

Optional Add-ons

- Claim expenses: From $4 per month

- Track projects: From $7 per month

- Analytics Plus: Try free for 4 months

Detailed Comparison: QuickBooks vs. Xero

- Accessibility: Both Xero and QuickBooks Online are cloud-based, making them easy to access anywhere. QuickBooks Desktop needs to be installed on a local computer.

- User Interface: Xero is known for being user-friendly, which is great if you're not an accountant. QuickBooks has more advanced features but can be more complicated.

- Automation: Both Xero and QuickBooks Online have strong automation features. QuickBooks Desktop is less advanced in this area.

- Mobile Support: Xero and QuickBooks Online have excellent mobile apps. QuickBooks Desktop's mobile app is more basic.

- Integrations: Xero slightly edges out with more integrations, but QuickBooks Online is also very good in this regard.

- Pricing: Xero offers good discounts for the first six months, making it cheaper at first. QuickBooks Online also has discounts, but long-term costs can be higher, especially for advanced plans.

- Customer Support: Both Xero and QuickBooks offer 24/7 support. QuickBooks Desktop’s support may cost extra if you need onsite help.

Features Comparison QuickBooks Vs Xero

Pricing comparison QuickBooks vs Xero

#2 QuickBooks alternative: FreshBooks

FreshBooks is cloud-based accounting software for freelancers, small business owners, and self-employed professionals. It's easy to use and has a simple interface.

FreshBooks is great for sending invoices, tracking expenses, logging work hours, and making financial reports. It's perfect if you need a straightforward accounting solution.

FreshBooks Pros:

- User-Friendly: FreshBooks is easy to navigate, even if you don't know much about accounting.

- Great Invoicing: You can create professional invoices, automate billing, and accept online payments easily.

- Time Tracking: You can log your work hours and bill clients accurately.

- Expense Management: It helps you keep track of your expenses.

- Good Customer Support: FreshBooks is known for its helpful and responsive support.

FreshBooks Cons:

- Limited Features for Big Businesses: FreshBooks doesn't have some advanced features that larger businesses might need, like inventory management.

- Pricing: Costs can add up as your business grows and you need more features or users.

- Fewer Integrations: FreshBooks doesn't connect with as many third-party tools as some competitors like QuickBooks and Xero.

How much does FreshBooks cost?

FreshBooks offers several pricing plans with various features and add-ons, tailored to meet different business needs. Here's a breakdown of the pricing for each plan:

- Lite Plan

- Price: $7.60/month for the first 4 months, then $19.00/month.

- Features: Up to 5 clients, unlimited invoices, expenses, estimates, and payments via credit cards and bank transfers (ACH).

- Add-ons: Team Members at $11 per user per month, Advanced Payments at $20 per month, and FreshBooks Payroll (price varies).

- Plus Plan (Most Popular)

- Price: $13.20/month for the first 4 months, then $33.00/month.

- Features: Everything in Lite, plus up to 50 clients, proposals, automated bill capture, collaboration tools, and financial reporting.

- Add-ons: Same as Lite, including team members at $11 per user per month, Advanced Payments at $20 per month, and FreshBooks Payroll.

- Premium Plan

- Price: $24.00/month for the first 4 months, then $60.00/month.

- Features: Everything in Plus, and service to an unlimited number of clients, project profitability tracking, accounts payable, and more.

- Add-ons: Same as Plus, but Advanced Payments are included.

- Select Plan

- Price: Custom pricing (need to contact for details).

- Features: Everything in Premium, plus lower transaction fees, custom onboarding, two team member accounts included, and more.

- Add-ons: Advanced Payments included, team members at $11 per user per month, and FreshBooks Payroll.

All plans offer a 30-day money-back guarantee, and there are promotional discounts of 60% off for the first four months.

Read Detailed comparison: FreshBooks vs QuickBooks

When deciding between FreshBooks and QuickBooks, it's essential to understand how their features compare to determine which software best suits your business needs.

Here’s a detailed explanation of the key features:

Accessibility:

- FreshBooks: Cloud-based, so you can access it from any device with internet.

- QuickBooks Online: Also cloud-based and offers the same convenience.

- QuickBooks Desktop: Needs to be installed on a specific computer, but can be accessed remotely with extra setup.

User Interface:

- FreshBooks: Very simple and user-friendly.

- QuickBooks Online: More complex but has more features.

- QuickBooks Desktop: Most complex, with a traditional interface.

Invoicing:

- FreshBooks: Excels in creating professional invoices, automating billing, and accepting online payments.

- QuickBooks Online: Strong invoicing capabilities with customization.

- QuickBooks Desktop: Comprehensive invoicing with more customization.

Expense Tracking:

- FreshBooks: Easy to track expenses by snapping photos of receipts and categorizing them.

- QuickBooks Online: Advanced expense tracking with automatic categorization.

- QuickBooks Desktop: Detailed expense tracking with advanced features.

Time Tracking:

- FreshBooks: Great built-in time tracking feature.

- QuickBooks Online: Offers time tracking but requires setup.

- QuickBooks Desktop: Available but less streamlined.

Payroll Management:

- FreshBooks: Limited, often needs third-party integration.

- QuickBooks Online: Integrated payroll services as an add-on.

- QuickBooks Desktop: Robust payroll management features.

Reporting:

- FreshBooks: Basic financial reports.

- QuickBooks Online: Advanced reporting capabilities.

- QuickBooks Desktop: Most advanced and customizable reporting options.

Integration:

- FreshBooks: Fewer integrations, connects with essential apps like Stripe and PayPal.

- QuickBooks Online: Integrates with over 750 apps.

- QuickBooks Desktop: Fewer integrations but works well with essential business applications.

Automation:

- FreshBooks: Basic automation features.

- QuickBooks Online: Advanced automation for tasks like bank reconciliation.

- QuickBooks Desktop: Limited automation.

Mobile App:

- FreshBooks: Comprehensive mobile app for invoicing, expenses, and time tracking.

- QuickBooks Online: Robust mobile app similar to the desktop version.

- QuickBooks Desktop: Basic mobile app mainly for data viewing.

Customer Support:

- FreshBooks: Excellent customer support.

- QuickBooks Online: 24/7 support, though response times can vary.

- QuickBooks Desktop: Comprehensive support, with additional costs for onsite help.

#3 QuickBooks alternative: Zoho Books

Let's talk about Zoho Books, another great alternative to QuickBooks.

Zoho Books is cloud-based accounting software designed for small to medium-sized businesses.

It helps with invoicing, tracking expenses, managing inventory, handling projects, and more. Zoho Books is part of the larger Zoho family of apps, which all work together to make managing your business easier.

It's easy to use, affordable, and helps you stay on top of your finances.

Zoho Books Pros:

- User-Friendly Interface: Zoho Books is easy to use, even if you're not an accountant.

- Comprehensive Features: It offers many features like invoicing, expense tracking, inventory management, and project management.

- Integration with Zoho Apps: It works well with other Zoho apps like Zoho CRM, Zoho Inventory, and Zoho Projects.

- Affordable: Zoho Books has competitive pricing with different plans to fit your business size and needs.

- Compliance and GST Filing: It helps you follow local tax rules, including GST filing, which is great if you have specific tax needs.

- Mobile Accessibility: You can manage your finances on the go with the Zoho Books mobile app.

Zoho Books Cons:

- Limited Advanced Features: It might not have all the advanced features that larger businesses need.

- Integration with Non-Zoho Apps: It integrates best with Zoho apps, so connecting with non-Zoho apps might be harder.

- Learning Curve for Advanced Features: While basic features are easy to use, some advanced features might take more time to learn.

- User Limitations: Each plan includes a limited number of users, and adding more users costs extra.

How much does Zoho Books cost?

Zoho Books provides a range of plans to meet the needs of businesses of all sizes, from free options for smaller enterprises to comprehensive plans for larger businesses with advanced requirements.

Free Plan

- Cost: $0/month

- Ideal For: Businesses with annual revenue < $50K USD

- Billed Annually: Free

- Features: Basic invoicing, expense tracking, mileage tracking, online payments, customer portal, bank reconciliation, and more.

Standard Plan

- Monthly Cost: $20/month

- Annual Cost: $15/month (Billed Annually: $180/year)

- Features: Everything in Free plan plus sales tax tracking, bank feeds, custom fields, custom reports, and more.

- Users: 3 Users

- Support: Email, Voice, and Chat Support

Professional Plan

- Monthly Cost: $50/month

- Annual Cost: $40/month (Billed Annually: $480/year)

- Features: Everything in Standard plan plus vendor bills, sales and purchase orders, multi-currency transactions, project profitability, inventory tracking, and more.

- Users: 5 Users

- Support: Email, Voice, and Chat Support

Premium Plan

- Monthly Cost: $70/month

- Annual Cost: $60/month (Billed Annually: $720/year)

- Features: Everything in Professional plan plus budget management, cashflow forecasting, vendor portal, custom domain, and more.

- Users: 10 Users

- Support: Email, Voice, and Chat Support

Detailed comparison: QuickBooks vs Zoho Books

Accessibility

- Zoho Books: Cloud-based and accessible from any device, offering flexibility and convenience for users to manage their finances from anywhere.

- QuickBooks Online: Similar to Zoho Books, it is cloud-based and accessible from any device, making it ideal for remote work and real-time financial management.

- QuickBooks Desktop: Requires installation on a specific computer, limiting accessibility to that device unless additional remote access solutions are implemented.

User Interface

- Zoho Books: Known for its simple and intuitive interface, making it easy for users to navigate and perform accounting tasks without extensive training.

- QuickBooks Online: While user-friendly, it offers more complex features which may require some learning for new users.

- QuickBooks Desktop: Designed for detailed accounting tasks, it has a more complex interface that might be overwhelming for beginners but is powerful for experienced users.

Invoicing

- Zoho Books: Provides professional invoicing capabilities with automation, including recurring invoices and payment reminders.

- QuickBooks Online: Offers extensive invoicing features with customizable templates, automated billing, and integration with other financial management tools.

- QuickBooks Desktop: Provides comprehensive invoicing options with advanced customization and control over invoicing processes.

Expense Tracking

- Zoho Books: Robust expense tracking with the ability to categorize expenses, attach receipts, and link expenses to specific projects or clients.

- QuickBooks Online: Advanced expense tracking, including automatic categorization and linking expenses to bank transactions, with detailed reporting.

- QuickBooks Desktop: Similar to QuickBooks Online, it offers comprehensive expense tracking with advanced categorization and reporting features.

Time Tracking

- Zoho Books: Integrated time tracking feature, especially useful for project-based businesses to log billable hours and convert them into invoices.

- QuickBooks Online: Offers time tracking but is less intuitive compared to Zoho Books, requiring additional setup or third-party integrations.

- QuickBooks Desktop: Provides time tracking capabilities, suitable for businesses needing detailed logging of time linked to projects or clients.

Payroll Management

- Zoho Books: Available in higher-tier plans, offering payroll management features to handle employee payments and tax calculations.

- QuickBooks Online: Provides integrated payroll services as an add-on, with automated tax calculations and direct deposit options.

- QuickBooks Desktop: Includes robust payroll management capabilities, suitable for businesses with complex payroll needs.

Reporting

- Zoho Books: Offers actionable insights with over 50 built-in reports, including profit and loss statements, balance sheets, and tax reports.

- QuickBooks Online: Advanced reporting capabilities with customizable reports and real-time data analysis.

- QuickBooks Desktop: Provides highly customizable reports with extensive financial data analysis and detailed business insights.

Integration

- Zoho Books: Strong integration with Zoho's suite of applications, but limited third-party integrations outside the Zoho ecosystem.

- QuickBooks Online: Integrates with over 750 third-party applications, offering versatility and adaptability to various business tools.

- QuickBooks Desktop: Limited third-party integrations but connects well with essential business applications.

Automation

- Zoho Books: Offers smart automation for workflows, including automated invoicing, expense tracking, and payment reminders.

- QuickBooks Online: Advanced automation features for various accounting tasks, reducing manual workload and increasing efficiency.

- QuickBooks Desktop: Limited automation compared to QuickBooks Online, requiring more manual input for tasks like bank reconciliation and expense tracking.

Mobile App

- Zoho Books: Comprehensive mobile app that allows users to manage invoicing, expenses, and time tracking on the go.

- QuickBooks Online: Robust mobile app providing features for managing invoices, expenses, and banking from a smartphone.

- QuickBooks Desktop: Basic mobile app primarily for data viewing, lacking the full functionality of the online versions.

Customer Support

- Zoho Books: Offers reliable support through email, voice, and chat, ensuring users can get assistance when needed.

- QuickBooks Online: Provides 24/7 support through various channels, including live chat and phone, known for reliable support.

- QuickBooks Desktop: Comprehensive support including phone and online help, though onsite support may incur additional costs.

Features comparison

How to Make Accounting Easier with Tools like Xenett?

No matter which QuickBooks alternative you pick, using Xenett can make your accounting much easier.

Xenett is a smart tool that helps you with accounting tasks, keeps your books accurate, and makes working with your team smoother.

Let's see how Xenett can help if you use Xero or QuickBooks.

How Xenett Helps with Xero and QuickBooks?

Accurate Books

- Automatic Error Detection: Xenett automatically finds and fixes mistakes in your accounting data, so your books stay accurate.

- Real-Time Updates: Fix errors as they happen, keeping your financial records up-to-date.

Faster Financial Close

- Automated Workflow: Xenett has checklists and workflows that make closing your books at the end of the month or year faster and easier.

- Efficiency: Automate boring tasks so you can focus on more important financial activities.

Easy Collaboration

- Client and Team Collaboration: Communicate better with your clients and team, saving time and avoiding the hassle of chasing information.

- Interactive Reporting: Share real-time reports with your team, making decision-making easier and more transparent.

Interactive Reports

- Dynamic Reporting: Use interactive reports instead of static PDFs, making it easier to share and work on reports together.

- Actionable Insights: Get deeper insights into your financial data, helping you make better business decisions.

Why Use Xenett?

- Error-Free Books: Keep your books accurate with automatic error detection.

- Faster Close: Spend less time closing your books each month and year.

- Seamless Integration: Xenett works smoothly with QuickBooks Online and Xero.

- Comprehensive Support: Get dedicated support, onboarding, and training to make the most of Xenett.

How much does Xenett cost?

Here’s a quick look at Xenett’s pricing plans:

- Quality Check Plan: $6/month per client

- Add-On: Client Portal: $1.5/month per client

- Comprehensive Close Plan (Most Popular): $9/month per client

Finally!

Finding the right accounting software can really make your business life easier. QuickBooks is great, but it might not be perfect for everyone. That’s why checking out some alternatives is a smart idea.

In this article, we talked about the top 3 QuickBooks alternatives: Xero, FreshBooks, and Zoho Books. Each one has cool features that might fit your business better.

Remember, when choosing the right software, look for something that:

🔥 Is super easy to use,

🔥 Has awesome invoicing and expense tracking,

🔥 Works well with other tools you use, and

🔥 Fits your budget nicely.

Switching to the right accounting software can save you time, reduce headaches, and help you manage your money better.

And here's a fun tip: Try Xenett!

It works smoothly with QuickBooks and Xero, making your accounting tasks even easier. Xenett helps keep your books accurate, closes your financials faster, and makes team collaboration a breeze.

It doesn’t work with FreshBooks or Zoho Books, but if you’re using QuickBooks or Xero, it’s a great add-on!

Ready to find the perfect accounting tool? Give these QuickBooks alternatives a try and see which one you like best. And don’t forget to add Xenett to the mix for even better results!

.svg)