Detailed Quickbooks Self Employed Accounting Software Guide

This blog is for you...

If you’re overwhelmed by managing your business finances.

OR

If you're struggling to keep your personal and business expenses separate.

OR

If tax time always seems to catch you off guard.

Every freelancer, solopreneur, and independent contractor wants to manage their finances efficiently.

You, me, everyone.

But there is a significant challenge that many face.

It's staying on top of financial management without dedicating too much time and effort.

Yes, I know you might be using spreadsheets or manual methods, but so do many others.

So, how do you get ahead?

That’s where QuickBooks Self-Employed comes in. It's a powerful tool created by Intuit that makes managing your finances much easier.

- It will help you track your income and expenses seamlessly.

- It will help you keep your business and personal finances separate.

- It will help you prepare for tax time with less stress.

I see what you’re thinking: “Yet another accounting tool with the same old promises.”

Let me explain why this blog is different:

In this blog, I’m sharing practical insights and strategies that have helped countless freelancers and solopreneurs streamline their financial management and focus more on their work.

You don’t need to start from scratch – you can easily implement these tips to enhance your business operations.

I’ll show you exactly how to use QuickBooks Self-Employed to take control of your finances:

🌟 We’ll start by understanding what QuickBooks Self-Employed is.

🌟 Then, we'll explore the key features and benefits of QuickBooks Self-Employed.

🌟 After that, we'll look into how tools like Xenett can enhance your experience by providing advanced analytics.

🌟 I'll also guide you through the process of setting up your QuickBooks Self-Employed account and connecting your bank accounts and credit cards.

🌟 Finally, we'll discuss the advanced features and reporting tools to help you make informed financial decisions.

So, without wasting any time, let’s dive into the details.

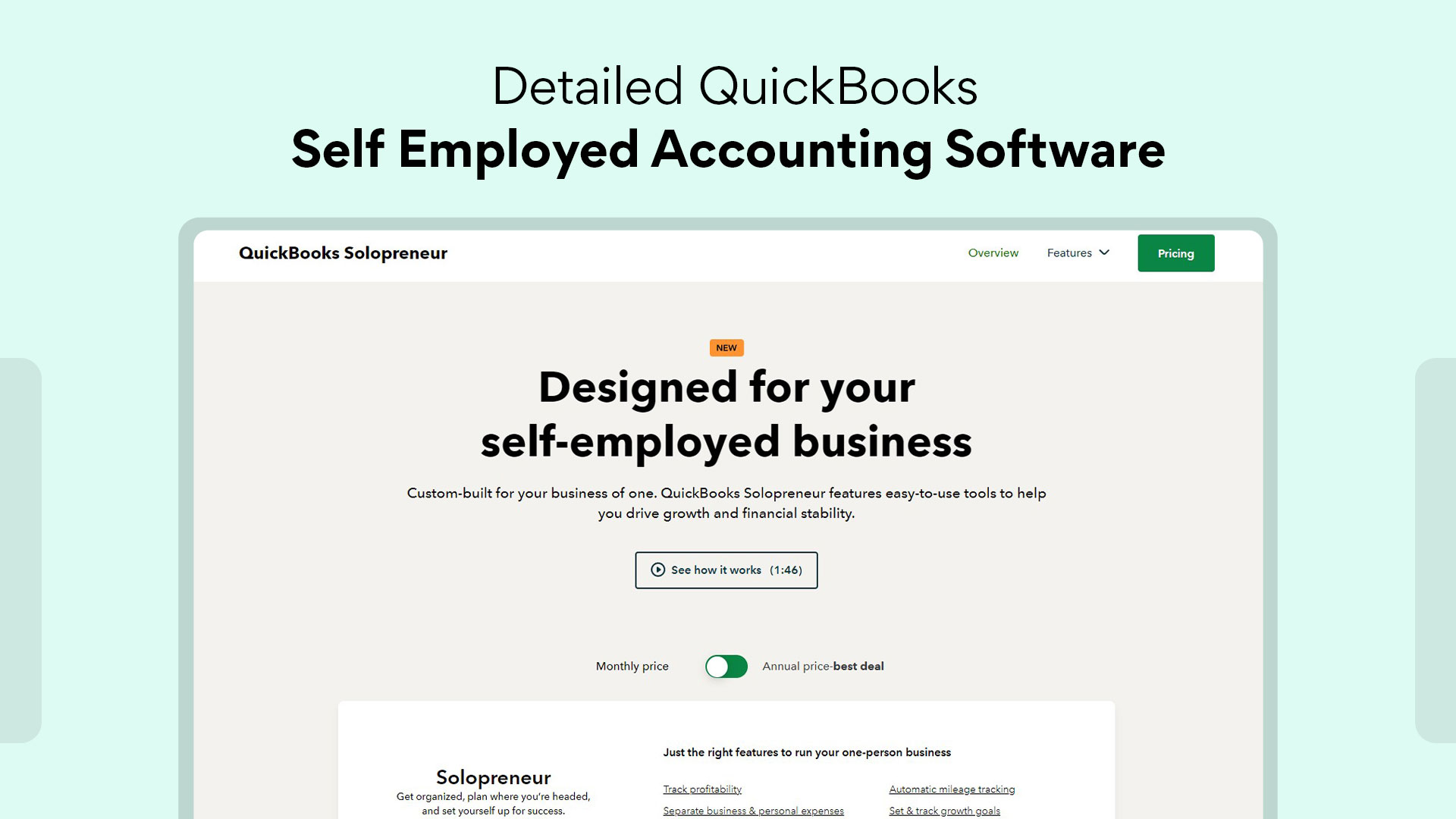

What is QuickBooks Self Employed?

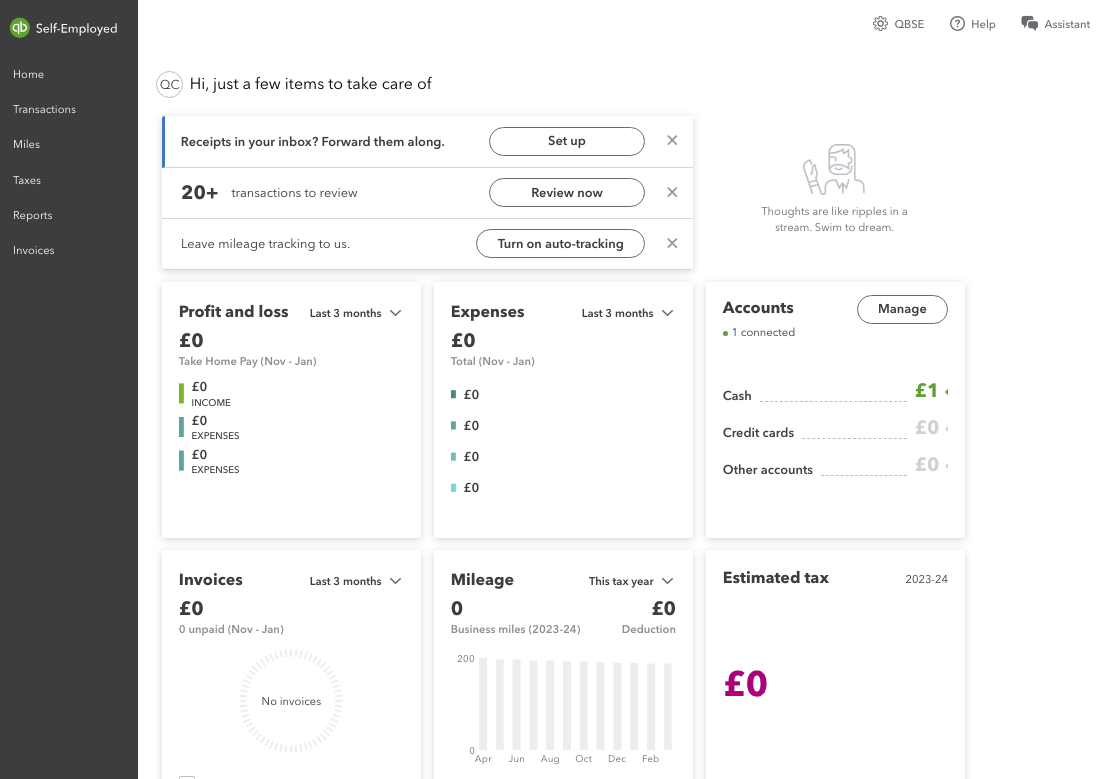

QuickBooks Self-Employed or QuickBooks Solopreneur is a tool that helps you manage your money easily.

If you work for yourself, like being a freelancer, solopreneur, or independent contractor, this tool is perfect for you.

QuickBooks Self-Employed is made by a company called Intuit. This tool helps you keep track of your money without much effort.

You can see how much money you make and spend, all in one place.

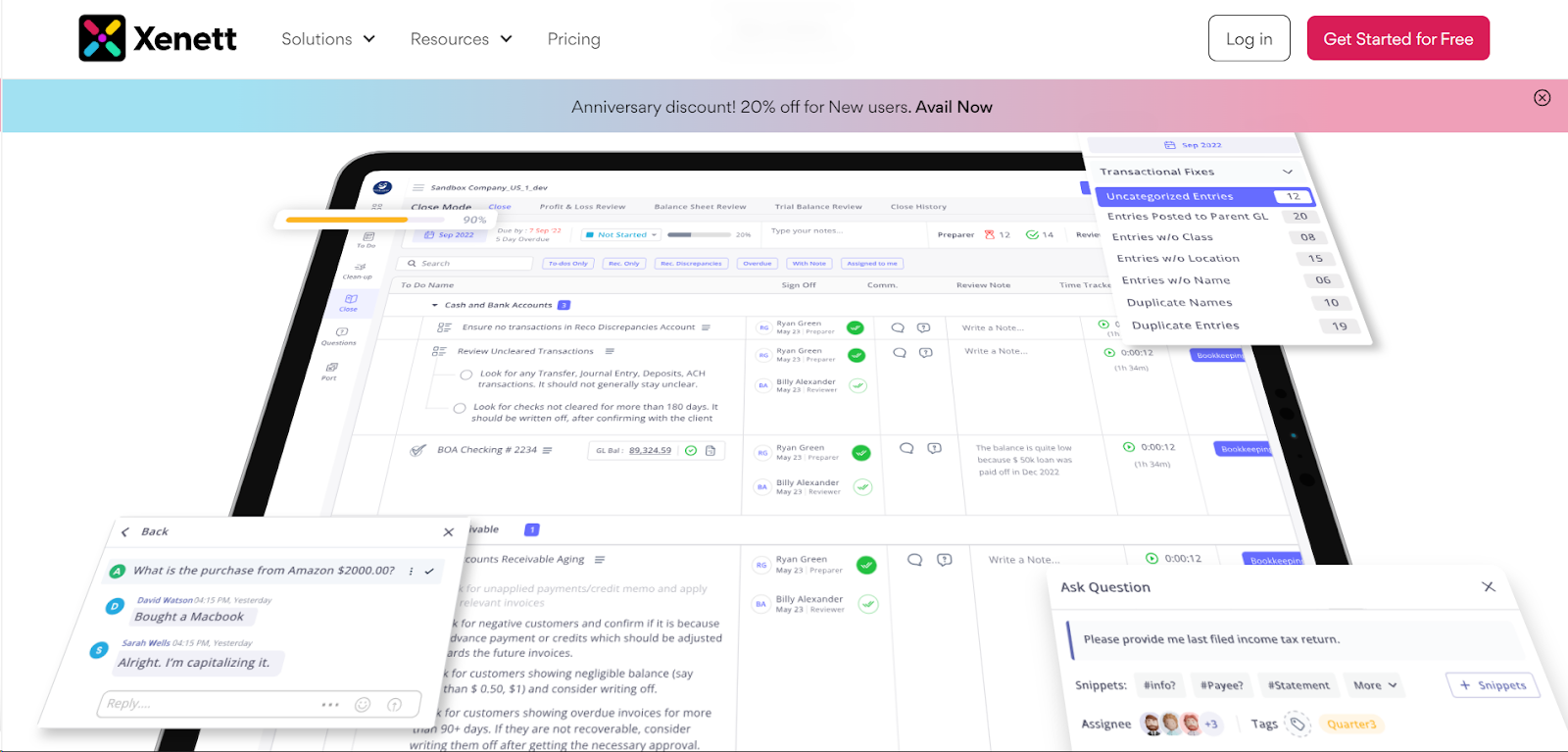

Additionally, tools like Xenett can complement QuickBooks Self-Employed by offering advanced data insights and detailed analytics for better financial decision-making.

How, you ask?

So Xenett can:

- Provide more detailed analytics, helping you understand your financial data at a deeper level. This can uncover trends and insights that QuickBooks alone might not highlight.

- you can generate more comprehensive and customizable reports, allowing for better tracking of your business performance and financial health.

- help automate the reconciliation process, reducing errors and saving time by ensuring your financial data is accurate and up-to-date.

- you can get more detailed tax summaries and reports, making tax preparation more straightforward and less stressful.

- The advanced analytics and detailed insights provided by Xenett support more informed financial decisions, helping you optimise your business operations and strategy.

Why is QuickBooks Self-Employed Good for Freelancers, Solopreneurs, and Independent Contractors?

Now, let’s see why QuickBooks Self-Employed is so great for people like you and me.

#1. Easy to Use

QuickBooks Self-Employed is very easy to use. You don’t need to be an expert with money or computers.

The instructions are clear, and the design is simple.

This means you can spend more time doing your work and less time worrying about your finances.

#2. Keep Personal and Business Finances Separate

One of the best parts is that you can keep your personal money and business money separate.

This helps you avoid confusion. When your personal and business money are separate, it’s easier to see how your business is doing.

You just connect your business credit card and bank accounts to QuickBooks, and it does the rest.

#3. Track Your Expenses Easily

QuickBooks Self-Employed makes it simple to track what you spend.

You can sort your expenses into different categories, like travel or supplies.

This is really helpful for doing your taxes because it shows where your money is going and helps you get the right deductions.

#4. Invoice Your Clients

You can quickly create and send invoices to your clients right from QuickBooks. It looks professional, and it’s fast.

Plus, QuickBooks helps you keep track of who has paid you and who still needs to pay.

This way, you always know what’s going on with your money.

#5. Track Mileage Automatically

If you drive for work, QuickBooks Self-Employed can track your mileage automatically.

This saves you a lot of time, and it makes sure you don’t miss out on any deductions for the miles you drive.

#6. Prepare for Taxes

QuickBooks helps you get ready for tax time by organising all your financial information.

It can even estimate how much you need to pay in taxes every few months, so you’re not surprised when it’s time to pay.

How to Get Started with QuickBooks Self-Employed?

Let’s go through the steps together to get you set up and running smoothly.

How to Set Up Your Company Profile

First things first, you need to set up your company profile. This is important because it helps QuickBooks understand your business better.

- Sign Up or Log In: Go to the QuickBooks Self-Employed website and sign up for an account. If you already have an Intuit account, you can log in with that.

- Enter Your Business Details:

- Business Name: Type in the name of your business.

- Business Address: Enter the address where your business is located.

- Contact Information: Provide a phone number and email address for your business.

- Tax Information:

- Business Type: Select the type of business you have, like sole proprietor or LLC.

- Tax ID Number: If you have a tax ID number, enter it here.

- Save Your Information: Make sure to save all the information you entered. QuickBooks will use this info to help you track your finances correctly.

Note: After setting up your QuickBooks profile, integrating Xenett enhances your data analysis and reporting. This integration simplifies tracking performance metrics and identifying growth opportunities, giving you deeper insights into your business’s financial health.

How to Connect Bank Accounts and Credit Cards

Next, let’s connect your bank accounts and credit cards. This will allow QuickBooks to automatically track your income and expenses.

- Go to the Banking Section: Once you’re logged in, go to the section called “Banking.” This is where you can connect your accounts.

- Add a Bank Account:

- Click on “Add Account”: Look for a button that says “Add Account” and click on it.

- Choose Your Bank: You will see a list of popular banks. If you don’t see yours, you can search for it.

- Enter Your Login Details: Use the same username and password you use for your bank’s website. QuickBooks uses this information to connect securely to your bank.

- Connect Your Credit Cards: You can do the same thing for your credit cards. Just follow the same steps as connecting your bank account.

- Review Your Transactions:

- Automatic Downloads: Once your accounts are connected, QuickBooks will automatically download your recent transactions.

- Categorise Transactions: You’ll see a list of your transactions. QuickBooks will try to guess the category (like “Travel” or “Supplies”), but you can change it if it’s wrong.

- Set Up Bank Rules: If you have regular transactions (like a monthly subscription), you can set up rules so QuickBooks categorise them automatically in the future. This saves you time and keeps everything organised.

Some Troubleshooting Tips:

Sometimes things don’t go as smoothly as we hope. Here are some common issues and how to fix them:

- Account Not Connecting: Double-check your login details for your bank. If it still doesn’t work, try reconnecting later.

- Duplicate Transactions: If you see the same transaction twice, you can exclude the duplicate one.

- Old Transactions Missing: QuickBooks usually downloads the last 90 days of transactions. If you need older ones, you can add them manually.

How to Manage Transactions?

Managing your transactions in QuickBooks Self-Employed is a breeze once you get the hang of it. Let’s walk through how to add, review, categorize, and set up rules for your transactions.

How to Manually Add Transactions?

Sometimes, you might need to add transactions manually, especially if they aren’t captured automatically. Here’s how you do it:

- Go to the Transactions Section: Log in to QuickBooks Self-Employed and navigate to the “Transactions” section.

- Click on “Add Transaction”: Look for a button that says “Add Transaction” and click on it.

- Enter the Transaction Details:

- Date: Choose the date when the transaction happened.

- Description: Write a brief description of the transaction.

- Amount: Enter the amount of the transaction.

- Category: Select the appropriate category for the transaction (like “Travel” or “Supplies”).

- Save the Transaction: Make sure all the details are correct and click “Save.” Now, your transaction is added to your records.

How to Review and Categorize Transactions?

QuickBooks Self-Employed makes it easy to review and categorise your transactions, ensuring your records are accurate.

- Go to the Transactions Section: In your QuickBooks account, head over to the “Transactions” section.

- Review Your Transactions:

- Unreviewed Transactions: You’ll see a list of transactions that need your review. Look for ones marked as “Unreviewed.”

- Check Details: Click on each transaction to check the details and make sure everything is correct.

- Categorise Transactions:

- Choose a Category: QuickBooks will suggest a category, but you can change it if it’s not right. Simply select the correct category from the list.

- Add Notes (Optional): If you want, you can add notes to the transaction for more context.

- Save Your Changes: After reviewing and categorising, click “Save.” This will update your records.

How to Use Advanced Features in QuickBooks Self-Employed

QuickBooks Self-Employed has some really cool advanced features that can make managing your business even easier.

Let’s dive into how to create and manage invoices, capture physical receipts, and track business mileage.

How to Create and Manage Invoices?

Creating and managing invoices in QuickBooks Self-Employed is simple and helps you keep track of your earnings. Here’s how you can do it:

- Go to the Invoices Section: Log in to QuickBooks Self-Employed and navigate to the “Invoices” section.

- Create a New Invoice:

- Click on “Create Invoice”: Look for a button that says “Create Invoice” and click on it.

- Enter Client Details: Type in the name and contact information of your client.

- Add Invoice Details:

- Date: Enter the date of the invoice.

- Due Date: Choose a due date for the payment.

- Items or Services: List the items or services you provided. Include a description, quantity, and price for each.

- Save and Send Invoice: Once all the details are filled in, you can save the invoice. You can also send it directly to your client via email from within QuickBooks.

- Manage Invoices:

- Track Status: In the “Invoices” section, you can see which invoices are paid, unpaid, or overdue.

- Send Reminders: If a client hasn’t paid yet, you can send them a reminder.

- Edit or Delete Invoices: If you need to make changes, you can edit the invoice or delete it if necessary.

How to Capture Physical Receipts?

Keeping track of physical receipts is important, and QuickBooks Self-Employed makes it easy to digitize them. Here’s how:

- Go to the Receipts Section: In your QuickBooks Self-Employed account, head over to the “Receipts” section.

- Capture a Receipt:

- Take a Photo: Use your smartphone to take a photo of the physical receipt.

- Upload the Photo: You can upload the photo directly into QuickBooks through the mobile app or website.

- Add Receipt Details:

- Match to Transaction: QuickBooks will try to match the receipt to an existing transaction. If it doesn’t find a match, you can manually add the details.

- Enter Information: Fill in the date, amount, and category for the receipt.

- Save and Store: Once all the details are entered, save the receipt. It will be stored digitally in QuickBooks, making it easy to find when you need it.

How to Track Business Mileage?

If you drive for work, tracking your mileage is essential for tax deductions. QuickBooks Self-Employed can help with this:

- Use the Mobile App: Download the QuickBooks Self-Employed app on your smartphone.

- Enable Mileage Tracking:

- Turn on Auto-Tracking: In the app, go to the “Mileage” section and enable automatic tracking. This way, the app will use GPS to track your trips automatically.

- Manual Entry: If you prefer, you can also enter your trips manually. Just click on “Add Trip” and fill in the details.

- Categorize Trips:

- Business or Personal: For each trip, mark it as either business or personal. This helps keep your records accurate for tax purposes.

- Review and Save:

- Check Details: Review the details of each trip to make sure everything is correct.

- Save the Trip: Save the trip details in QuickBooks.

Troubleshooting Tips

Here are a few tips if you run into issues:

- Invoices Not Sending: Double-check the email addresses and try resending.

- Receipts Not Matching: Manually add the details if QuickBooks doesn’t find a match.

- Mileage Not Tracking: Ensure GPS is enabled on your phone and the QuickBooks app has the necessary permissions.

How to Handle Reporting and Tax Preparation in QuickBooks Self-Employed

Let’s talk about two important tasks in QuickBooks Self-Employed: running business reports and preparing for tax time.

These features help you stay on top of your finances and ensure you’re ready when taxes are due.

How to Run Business Reports in QuickBooks Self Employed?

Running business reports in QuickBooks Self-Employed gives you a clear picture of your financial health. Here’s how you can do it:

- Go to the Reports Section: Log in to QuickBooks Self-Employed and navigate to the “Reports” section.

- Choose a Report to Run:

- Profit and Loss Report: This report shows your income and expenses, helping you see how much money you’re making.

- Expense Report: This report breaks down your spending by category, so you know where your money is going.

- Mileage Log: If you track your mileage, this report shows all your business trips and the total mileage.

- Customize the Report:

- Date Range: Select the time period you want to look at, like last month or the entire year.

- Categories: Choose which categories you want to include in the report.

- Generate the Report: Once you’ve set your preferences, click “Run Report.” QuickBooks will create the report based on your settings.

- Review and Save:

- Check the Details: Review the report to make sure all the information is correct.

- Save or Print: You can save the report as a PDF or print it out for your records.

How to Prepare for Tax Time in QuickBooks self employed?

Preparing for tax time can be stressful, but QuickBooks Self-Employed makes it much easier.

Here’s how to get ready:

- Organize Your Transactions:

- Review and Categorize: Make sure all your transactions are reviewed and categorized correctly. This helps ensure your tax information is accurate.

- Match Receipts: Ensure that all your receipts are matched with the right transactions.

- Track Your Deductions:

- Business Expenses: Keep track of all your business expenses. QuickBooks helps you identify what can be deducted.

- Mileage: If you’ve been tracking your business mileage, make sure it’s all recorded correctly.

- Use Tax Reports:

- Tax Summary Report: This report summarizes your income and deductible expenses, making it easier to see what you owe.

- Tax Details Report: This report provides detailed information on each transaction, which is helpful if you need to explain anything to the tax authorities.

- Estimate Quarterly Taxes:

- Quarterly Tax Calculator: QuickBooks can estimate how much you need to pay in quarterly taxes. This helps you avoid any surprises when tax time comes around.

- Set Aside Money: Based on the estimates, set aside money for your quarterly tax payments.

- File Your Taxes:

- Export Data: You can export your data from QuickBooks to share with your accountant or import into tax filing software.

- Use TurboTax: If you use TurboTax, it integrates seamlessly with QuickBooks, making filing even easier.

Here again, Xenett can simplify tax preparation by offering detailed tax summaries and easy export options for your accountant. This integration ensures you have accurate and comprehensive tax records.

What Are the QuickBooks Self-Employed Plans and Pricing?

Let’s talk about the pricing for QuickBooks Solopreneur. This tool is made just for self-employed folks like you. It’s packed with features that make managing your business finances a breeze.

QuickBooks Solopreneur is tailor-made for solo business owners. It helps you keep track of everything you need to manage your finances smoothly. Here’s what you get:

Key Features:

- See how much profit you’re making

- Automatically track your mileage

- Keep business and personal expenses separate

- Set goals and track your progress

- Create and customize estimates and invoices

- Keep an eye on sales and sales tax

- Accept payments from clients

- Open a business bank account

- Get help with tax preparation from experts

- Earn 5.00% APY on your savings

- Access everything through a handy mobile app

Pricing Options

Monthly Plan:

- Regular Price: $20 per month

- Summer Special: Only $6 per month for the first 3 months (That’s a 70% discount!)*

Annual Plan:

- Best Deal: Save 50% off the annual list price for the first year when you choose the annual plan.

Special Offers

Summer Savings! Get 70% Off for the First 3 Months

- Discounted Monthly Price: Just $6 per month for the first 3 months.

- Hurry! This offer ends July 29th, so don’t miss out!

Free 30-Day Trial

- Try Before You Buy: Enjoy a free 30-day trial to see if QuickBooks Solopreneur is right for you. After the trial, you’ll be charged the regular monthly fee unless you cancel.

- Buy Now: Click “Buy Now” to grab the 70% discount for the first 3 months. Or start with the free 30-day trial to check it out first.

Important Details

Free Trial for 30 Days:

- Your first 30 days are free.

- After the trial, you’ll need to provide a credit card to continue using the service.

- You’ll be charged the regular monthly fee after the trial unless you cancel.

Discount Offer:

- The 70% discount is valid for the first 3 months.

- After 3 months, you’ll pay the regular price of $20 per month.

- This offer is only for new QuickBooks customers.

Annual Plan Offer:

- Save 50% on the annual price for the first year.

- After the first year, the regular annual price will apply.

- This offer is only for new customers who choose the annual plan.

Is QuickBooks Self-Employed Still Worth It in 2024?

Absolutely, QuickBooks Self-Employed remains a valuable tool for freelancers, solopreneurs, and independent contractors.

However, there are a few considerations:

- If you are just starting out, the basic features of QuickBooks Self-Employed will be more than sufficient.

- If you have a growing business and need deeper insights, integrating tools like Xenett will provide advanced analytics and detailed reports.

You may easily track your income and expenses.

You may keep your personal and business finances separate.

You may prepare for tax time with less hassle.

But

You won’t get in-depth financial analytics with QuickBooks alone.

You won’t have fully customizable reports without additional tools.

You won’t automate all your financial processes.

This is where a tool like Xenett complements QuickBooks Self-Employed.

It will provide advanced data insights for better financial decision-making.

It will generate more comprehensive and customizable reports.

It will automate the reconciliation process, ensuring your data is accurate and up-to-date.

And the best part? The added efficiency means you can focus more on growing your business and less on managing your finances.

Yes, you read it right.

Using QuickBooks Self-Employed, possibly with Xenett, can transform how you handle your business finances.

Ready to take your financial management to the next level? Try Xenett today and see how it can enhance your QuickBooks Self-Employed experience.

That’s all for today.

Happy managing your finances with QuickBooks Self-Employed!

.svg)