How to send an accountant's copy of quickbooks? [in 5 min]

![How to send an accountant's copy of quickbooks? [in 5 min]](https://cdn.prod.website-files.com/62ff26d72ea5e01571feb3d8/66ab5b0b8f425e09a50c5071_How%20to%20send%20an%20accountant%27s%20copy%20of%20quickbooks.jpg)

Hey, have you ever wondered if there's a quicker and more efficient way to send your accountant your QuickBooks data without interrupting your work?

In such a scenario, what's that one thing that can give you that extra push?

Take a guess, I’ll give you 3 seconds😉

The answer is: Sending an Accountant's Copy in QuickBooks!

Hmm.. What's that?

I’ll tell you all that and more!

But to brief it, an Accountant's Copy is a special version of your company file that allows your accountant to review and make changes without disrupting your workflow.

Sounds interesting?

Keep reading, and you’ll know more about:

🗒️Why you need to send an Accountant's Copy?

🤹How to create an Accountant's Copy in QuickBooks?

💻Steps to send the Accountant's Copy quickly and securely

🤔Tips to ensure a smooth process, and

⚠️Best practices to avoid common issues!

Now, if you’re ready to simplify your accounting process, let’s begin!

Before You Start: Key Preparation Steps to Send an Accountant's Copy of QuickBooks

Identify the Need

First, let's talk about why you need to send an accountant's copy of QuickBooks.

Imagine your accountant making changes to your financial records without interrupting your work. This special version of your company file lets your accountant do just that.

They can make the necessary adjustments while you keep working, which helps keep everything accurate and up-to-date.

Ensure QuickBooks is Up-to-date

Next, we need to make sure your QuickBooks software is up-to-date. This is important to avoid any issues when you create and send the accountant's copy.

Here's how you do it:

- Open QuickBooks.

- Go to the Help menu at the top.

- Click on Update QuickBooks.

- Follow the instructions to download and install any updates.

Keeping QuickBooks updated ensures everything runs smoothly.

Backup Your Data

Before we make any changes, it's crucial to back up your company file. Think of it as saving a copy of your work before making any edits.

Here's how you can back up your data:

- Open QuickBooks.

- Go to the File menu.

- Select Backup Company.

- Click on Create Local Backup.

- Follow the prompts to save your backup in a secure place.

This way, you have a safe copy of your data in case anything goes wrong.

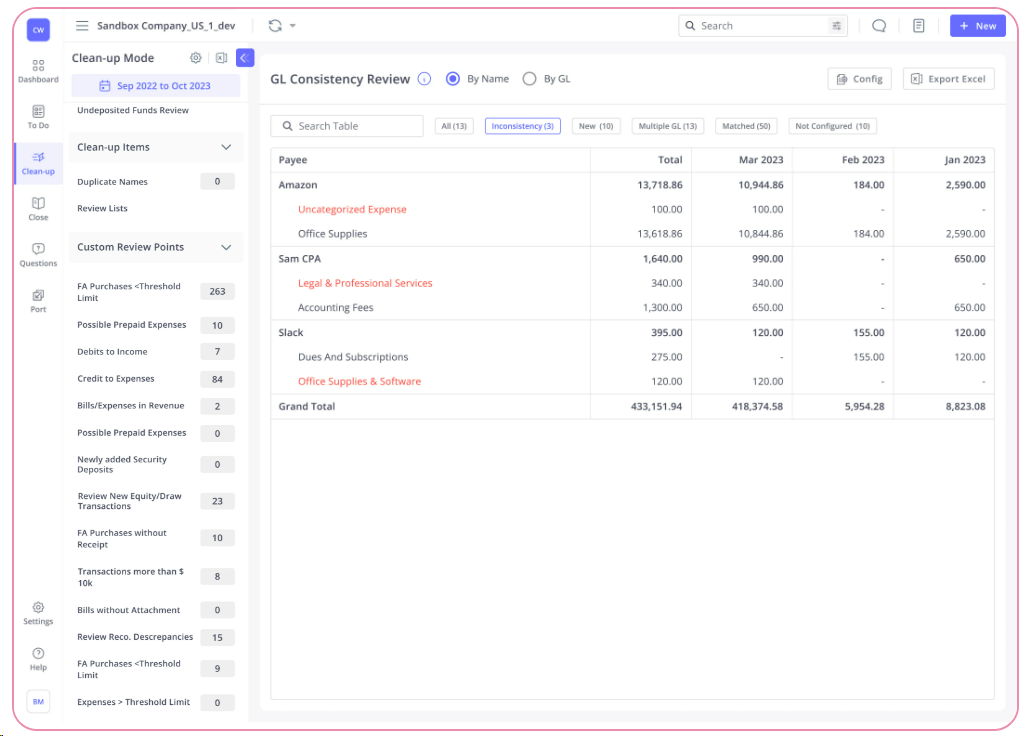

How Xenett Can Help You Send an Accountant's Copy in QuickBooks

When you need to send an accountant's copy in QuickBooks, it's important that your data is correct.

Here's how Xenett, a financial close software can help make sure everything is in good shape:

- Check Your Data:

Find Errors: Xenett looks through your QuickBooks data to find any mistakes or problems. This helps ensure the information you send to your accountant is accurate.

Automatic Checks: It does this automatically, so you don't have to manually look for errors.

- Make Your Data Better:

Organize Data: Xenett helps to clean up and organize your data, making it easier for your accountant to understand.

Remove Duplicates: It also removes any duplicate entries and fixes any incorrect information.

- Get Ready for Transfer:

Ensure Data is Ready: Xenett makes sure your QuickBooks data is all set before you create the accountant’s copy. This reduces the chance of problems during the transfer.

Check Compliance: It checks that your data follows all the necessary accounting rules and standards.

- Increase Confidence and Accuracy:

Be Confident: Using Xenett gives you confidence that your data is correct and up-to-date.

Reduce Errors: It helps reduce any accounting errors that could cause delays or need fixing later.

How to create an Accountant's Copy in QuickBooks?

Let's go through the steps to create an accountant's copy of your QuickBooks file. I'll explain each step as if we're sitting together and doing this process.

Step 1: Set Up QuickBooks

If you are using QuickBooks Desktop Enterprise, there's a small step you need to do first. You need to turn off the Advanced Inventory features.

This is only for Enterprise users. If you use QuickBooks Desktop Pro or Premier, or if you don't use Advanced Inventory, you can skip this step.

To turn off Advanced Inventory features:

- Open QuickBooks.

- Go to the Edit menu.

- Select Preferences.

- Click on Items & Inventory on the left.

- Select the Company Preferences tab.

- Uncheck the Advanced Inventory box.

Don't worry, you can turn this feature back on after you create the accountant's copy.

Step 2: Open QuickBooks

Next, let's open QuickBooks. Make sure you have your company file ready. Now, you need to be in Single User Mode to create an accountant's copy. Here's how you switch to Single User Mode:

- Go to the File menu at the top left of QuickBooks.

- Select Switch to Single-User Mode.

This ensures only you can make changes while creating the accountant's copy.

Step 3: Go to the File Menu

Now that you're in Single User Mode, let's start creating the accountant's copy:

- Go to the File menu.

- Hover your mouse over Send Company File.

- Then, hover over Accountant's Copy.

- Finally, click on Client Activities.

This will open a submenu with different options.

Step 4: Choose Accountant's Copy

In the submenu that appears:

- Select Save File.

- Click on Next.

- Choose Accountant's Copy and then click Next again.

QuickBooks is now preparing to create the accountant's copy.

Step 5: Set Dividing Date

The last step is to set a dividing date. This is the date that marks where your accountant can start making changes. It’s like drawing a line in the sand. Anything before this date can be changed by your accountant, but you can still work on anything after this date.

- Enter a date that works for your business.

- Click Next.

QuickBooks will now create the .QBX file. This is the special file that you will send to your accountant. Save this file to your computer in a location you can easily find.

By following these steps, you've created an accountant's copy of your QuickBooks file. It's a simple process that lets your accountant make changes without interrupting your daily work. Now, you're ready to move on to sending this file to your accountant.

Steps to send the Accountant's Copy quickly and securely in QuickBooks

Now that we've created the accountant's copy of your QuickBooks file, let's go through the steps to send it to your accountant. I'll explain everything as if we're chatting and doing this together.

Step 6: Create a File to Share

First, you need to save the .QBX file you created. This is the special file your accountant will use.

You have a few options for sharing this file:

Option #1 Save to a USB Drive: You can save the file to a USB drive and give it to your accountant in person.

- Insert a USB drive into your computer.

- Find the .QBX file on your computer.

- Copy and paste the file to the USB drive.

Option #2 Email the File: You can also send the file via email.

- Open your email program.

- Create a new email.

- Attach the .QBX file to the email.

- Send the email to your accountant.

Option #3 Use a Cloud Service: If you prefer, you can use a cloud service like Box, Dropbox, or Google Drive.

- Upload the .QBX file to the cloud service.

- Share the file link with your accountant.

Choose the method that works best for you and your accountant.

Step 7: Use the Accountant's Copy File Transfer Service

If you want an even easier way to send the file, you can use QuickBooks' built-in file transfer service. This service lets you send the file directly through QuickBooks. Here’s how:

- Go to the File Menu: Open QuickBooks and go to the File menu.

- Send Company File: Hover over Send Company File.

- Accountant's Copy: Hover over Accountant's Copy.

- Client Activities: Click on Client Activities.

- Send to Accountant: Select Send to Accountant and then click Next.

- Enter Email Addresses: Type in your email address and your accountant’s email address.

- Create a Password: Create a password for the file. Your accountant will need this password to open the file.

- Send the File: Click Send. QuickBooks will close all open windows and send the file. Your accountant will receive an email with a link to download the file. They will have two weeks to download it.

Using this service is secure and convenient. It saves you time and ensures your accountant gets the file quickly.

By following these steps, you've successfully sent the accountant's copy of your QuickBooks file. Now, your accountant can start working on it, and you can continue with your tasks without any interruptions.

What to Do After Sending the Accountant's Copy of QuickBooks?

Now that you've sent the accountant's copy, let's go through the final steps to make sure everything goes smoothly. Think of this as wrapping up the whole process neatly.

Confirm Receipt with Accountant

First, you need to make sure your accountant has received the file and can open it. This is very important to avoid any delays. Here's what you should do:

- Send a Quick Message: After sending the file, send a quick email or call your accountant to confirm they got it.

- You can say something like, "Hi [Accountant's Name], I just sent the accountant's copy of our QuickBooks file. Can you please confirm that you received it and can open it?"

- You can say something like, "Hi [Accountant's Name], I just sent the accountant's copy of our QuickBooks file. Can you please confirm that you received it and can open it?"

- Check for Confirmation: Wait for your accountant to confirm they have the file and can access it. This step ensures they can start working on it right away without any problems.

Monitor for Changes

While your accountant is working on the file, it's good to stay in touch. They might need more information or have questions about specific transactions. Here's how you can handle this:

- Stay Available: Keep an eye on your email or phone in case your accountant needs to reach you.

- Provide Additional Info: If your accountant asks for more details or explanations, respond quickly to keep things moving smoothly.

- For example, if they ask about a specific transaction, you can provide more context or details as needed.

Integrating Changes

Once your accountant has finished making adjustments, they will send you an updated file. This updated file will include all the changes they made. Here’s how to integrate these changes into your QuickBooks:

- Receive the Updated File: Your accountant will send you a file with their changes. Save this file to your computer.

- Open QuickBooks: Launch QuickBooks and open your company file.

- Go to Import Changes: Navigate to File > Accountant's Copy > Import Accountant's Changes.

- Follow the Prompts: QuickBooks will guide you through the steps to import the changes. Follow these prompts carefully.

- QuickBooks will show you the changes your accountant made. Review these changes and confirm to import them.

By following these steps, you’ll successfully integrate the changes into your QuickBooks file. This ensures your financial records are accurate and up-to-date.

So, to wrap it up:

- Confirm that your accountant received and can access the file.

- Stay in touch with your accountant in case they need more information.

- Import the changes once your accountant is done.

This way, you keep everything organized and efficient, ensuring your books are always in good shape.

How to Fix Problems with Your Accountant's Copy of QuickBooks?

Sometimes, things don't go as planned. Let’s go over some common problems you might face and how to solve them. Don’t worry, I’ll walk you through it step-by-step.

File Size Limitations

Sometimes, the file you’re trying to send is too big to email. Here’s what you can do:

- Compress the File: You can make the file smaller by compressing it.

- Right-click on the file.

- Select "Send to" and then "Compressed (zipped) folder."

- This will create a smaller zip file that you can email.

- Use Cloud Storage: If the file is still too big, use a cloud storage service like Dropbox or Google Drive.

- Upload the file to your cloud storage.

- Share the link to the file with your accountant.

Internet Connectivity Problems

If you have trouble with your internet connection while trying to send the file, try these solutions:

- Try Again Later: Sometimes, the internet is just slow. Try sending the file at a different time when the connection might be better.

- Use a USB Drive: If the internet issue persists, save the file to a USB drive.

- Plug the USB drive into your computer.

- Copy the file to the USB drive.

- You can then deliver the USB drive to your accountant in person.

Error Messages

If you see error messages while trying to send the file, here’s what you can do:

- Check QuickBooks Support: QuickBooks has a support site with solutions for many common errors.

- Go to the QuickBooks support website.

- Type the error message into the search bar.

- Follow the troubleshooting steps provided.

- Contact QuickBooks Support: If you can’t fix the error yourself, you can always contact QuickBooks support for help.

- They can guide you through the process and help resolve the issue.

By following these steps, you can solve most common problems that come up when sending an accountant's copy of QuickBooks.

Remember, it’s okay to ask for help if you need it. This way, you can ensure that your accountant gets the file without any hassle.

Conclusion

Yay, you made it to the end!

I hope you learned something new about how to send an accountant's copy of QuickBooks quickly and easily.

This process helps your accountant make important changes without interrupting your work.

Remember to keep QuickBooks up-to-date, back up your data, and consider using tools like Xenett to optimise your files.

By following these steps, you can ensure that your financial records are always accurate and up-to-date.

You can also avoid common issues by troubleshooting file size limitations, internet problems, and error messages.

That’s it for today,

Toodles!

.svg)