QuickBooks Online Reviews: 1000+ Accountants Real Experiences Demystified

This blog is perfect for you if you're an accountant who…

finds it hard to manage your clients' business finances.

Whether you’re an individual practitioner with many clients, a small accounting agency owner keeping track of client’s expenses, or running a larger company, I am here to help.

QuickBooks is a tool that can make managing money easier. In this blog, I will show you why QuickBooks is trusted by many accounting businesses or firms and how it can help you too.

In this article, you will learn:

- What QuickBooks is: Understand how it can simplify your financial or accounting tasks.

- Key Features: See how QuickBooks helps with invoicing, payroll, expense tracking, and more.

- Real User Experiences: Hear from over 1,000 accountants who use QuickBooks.

- Different Versions: Find out which QuickBooks version is right for you.

- Pricing: Learn about the costs and choose the best option for your budget.

By the end of this blog, you will know how QuickBooks can help you manage your finances better and make smart business decisions.

Let’s get started and see how QuickBooks can make your financial management easier!

What is Quickbooks?

Quickbooks is an accounting software created by Intuit, and it's designed specifically for small to medium-sized businesses, freelancers, and people who work for themselves.

It helps you save time and reduce the stress of managing your finances.

So if you have a lot of different financial or accounting tasks to manage, like keeping track of your expenses or your clients, sending invoices, running payroll, and preparing for taxes then QuickBooks can make all these tasks easier.

You and I know how stressful it can be to handle all this manually, but with QuickBooks, you can manage everything in one place.

Here’s a simple breakdown of what QuickBooks can do for you:

- Bookkeeping: You can record and organise all your financial transactions. This way, you always know where your money is going and coming from.

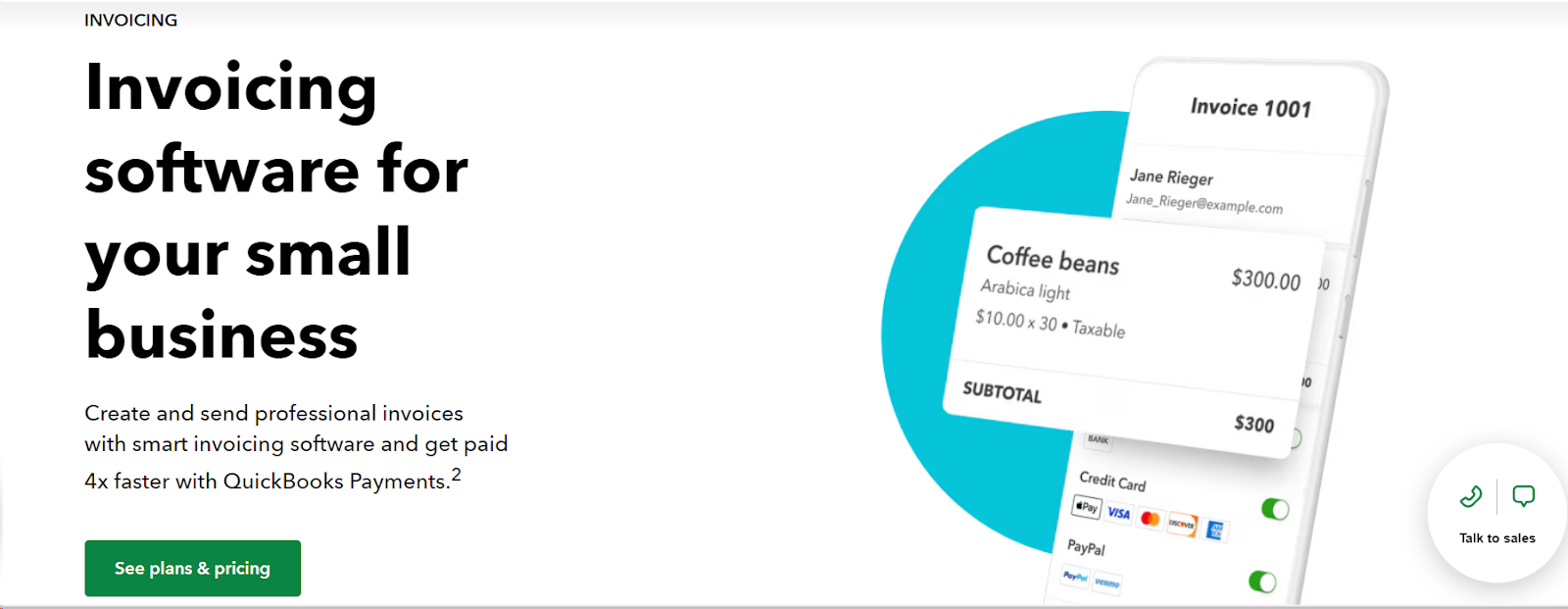

- Invoicing: Need to get paid for your services? QuickBooks lets you create and send professional invoices. You can even track when customers have viewed and paid their invoices.

- Payroll: Paying your employees is easy with QuickBooks. It helps you calculate paychecks, deduct the right taxes, and even handle benefits.

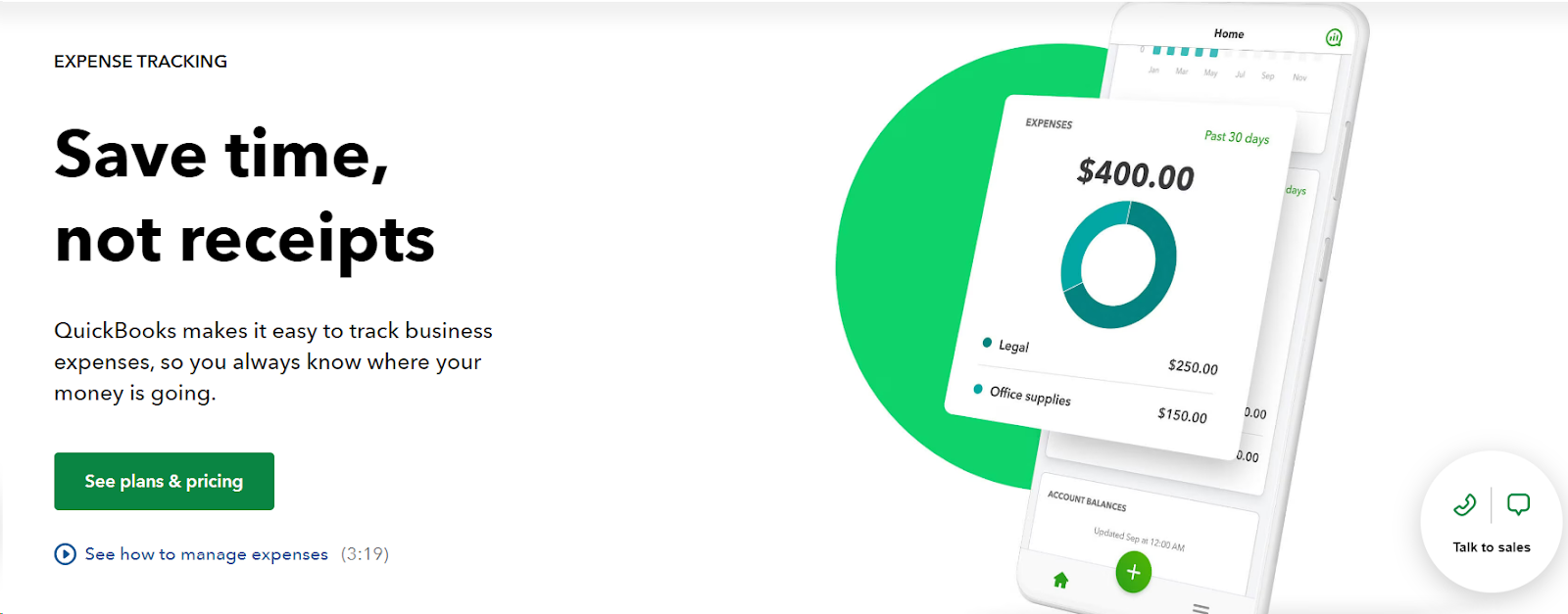

- Expense Tracking: You can keep track of all your business expenses. This helps you see where you’re spending money and can make it easier when it’s time to do your taxes.

- Tax Preparation: Speaking of taxes, QuickBooks can help you get ready for tax season. It organizes your financial information so you can easily find what you need when it’s time to file.

Benefits of Using QuickBooks:

- User-Friendly: Intuitive interface that simplifies accounting tasks for non-accountants.

- Time-Saving: Automates repetitive tasks such as invoicing, payroll, and bank reconciliation.

- Scalable: Offers solutions for various business sizes, from solo entrepreneurs to large enterprises.

- Cost-Effective: Reduces the need for extensive accounting staff or outsourcing.

- Real-Time Data: Provides up-to-date financial data for better decision-making.

- Compliance: Helps businesses stay compliant with tax regulations and reporting requirements.

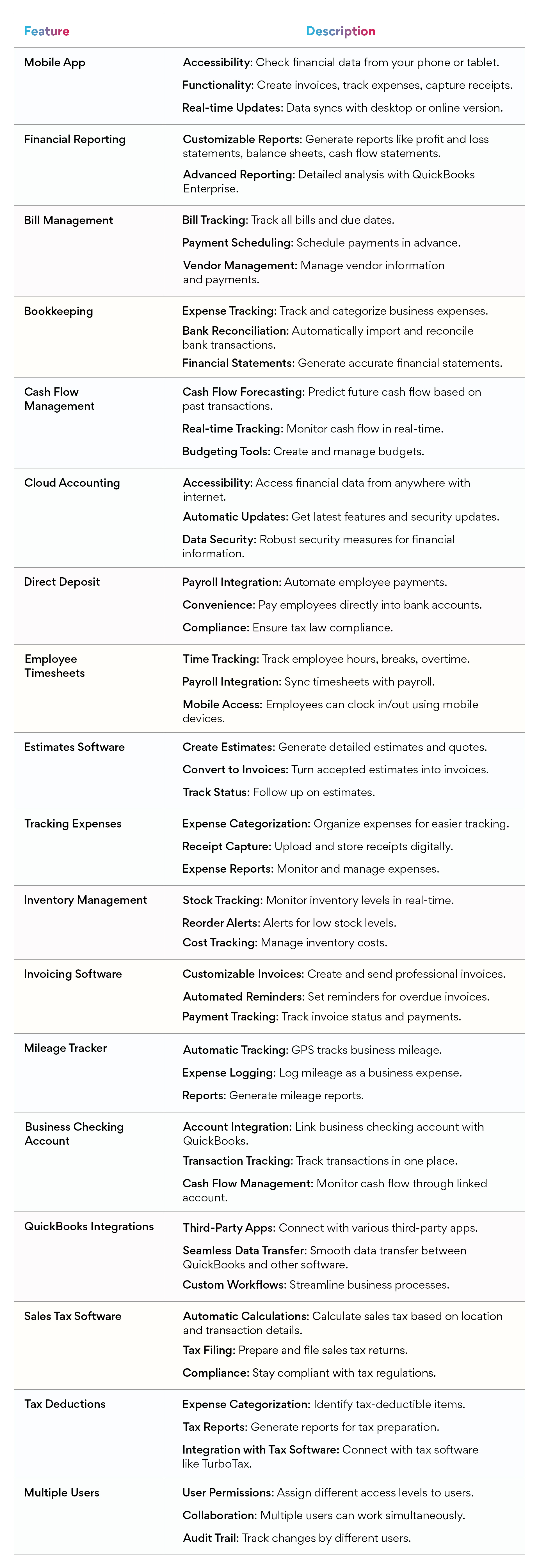

What features does Quickbooks offer?

Let’s look at what QuickBooks can do for you. Whether you're managing your business from your office or on the go, QuickBooks has a range of features that make handling finances easy.

If you’re in hurry, here is a table summarizing the features of QuickBooks:

This table provides a comprehensive overview of the key features offered by QuickBooks, making it easier to understand how each feature can benefit your business.

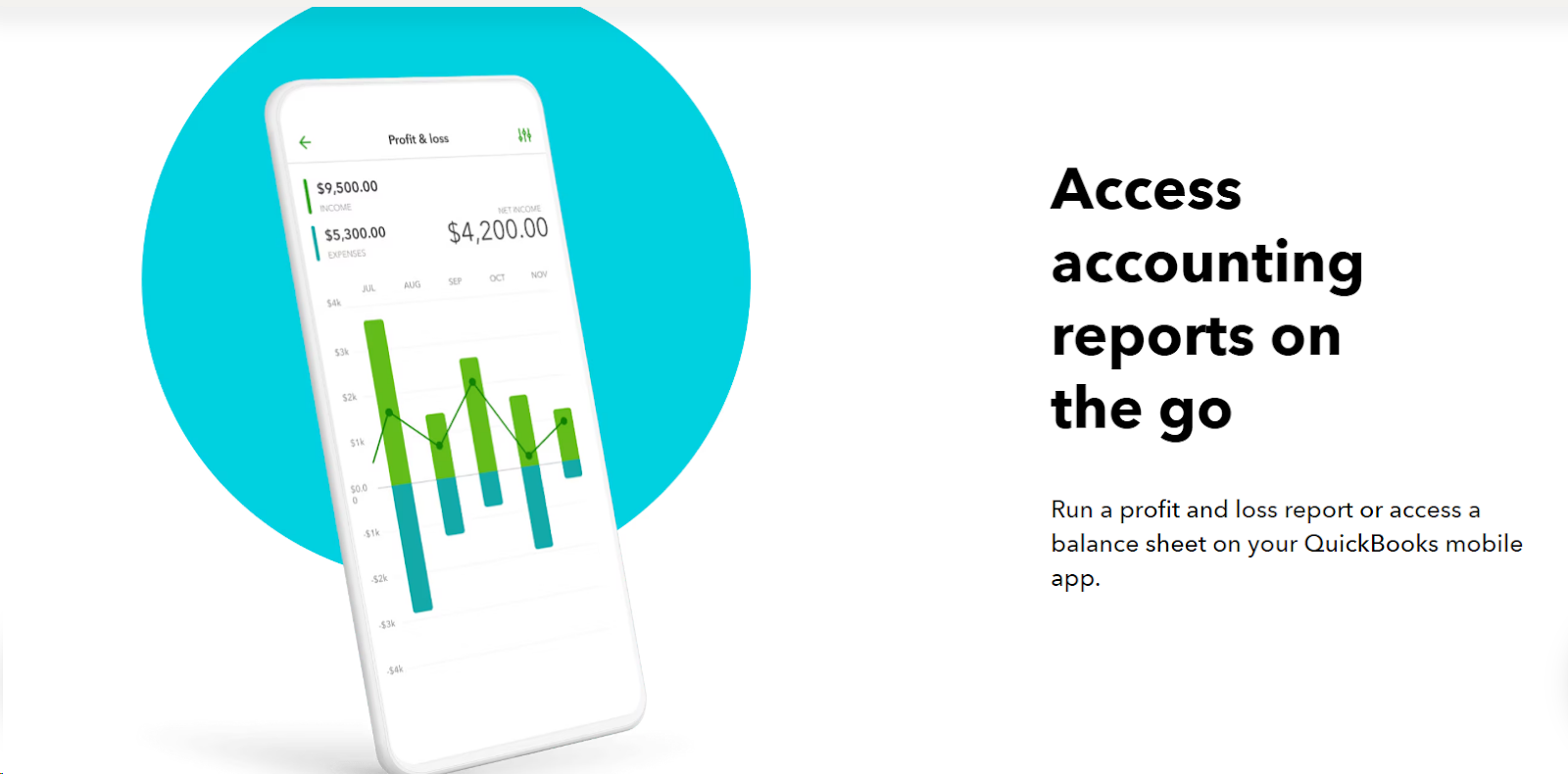

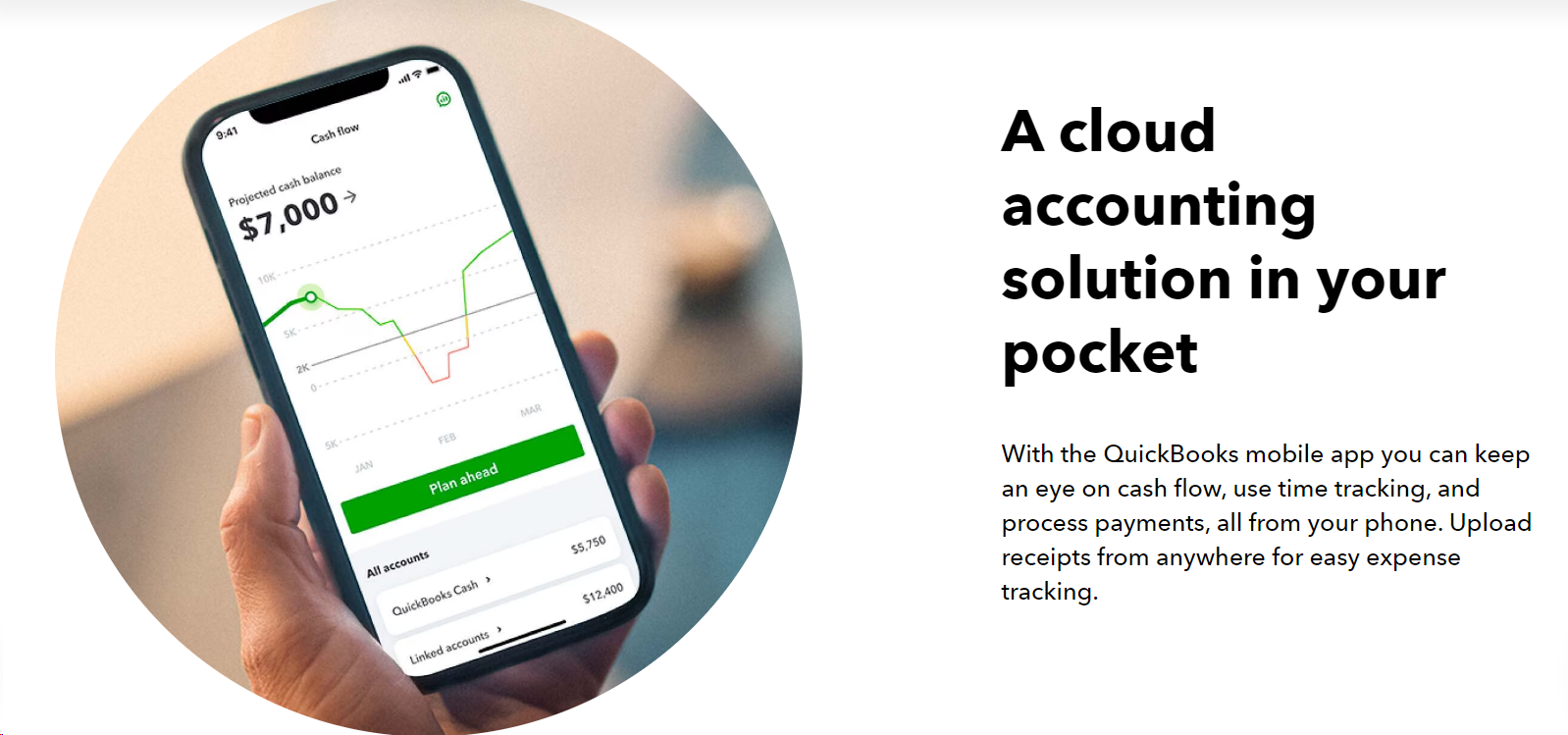

Mobile App

- Accessibility: You’ll be able to check your financial data wherever you are. QuickBooks' mobile app lets you access everything from your phone or tablet.

- Functionality: You can create invoices, track your expenses, and capture receipts with just a few taps.

- Real-time Updates: Your data syncs with the desktop or online version of QuickBooks, so you're always up-to-date.

Financial Reporting

- Customizable Reports: You can generate various reports like profit and loss statements, balance sheets, and cash flow statements to see how your business is doing.

- Advanced Reporting: For a more detailed analysis, QuickBooks Enterprise offers advanced reporting features.

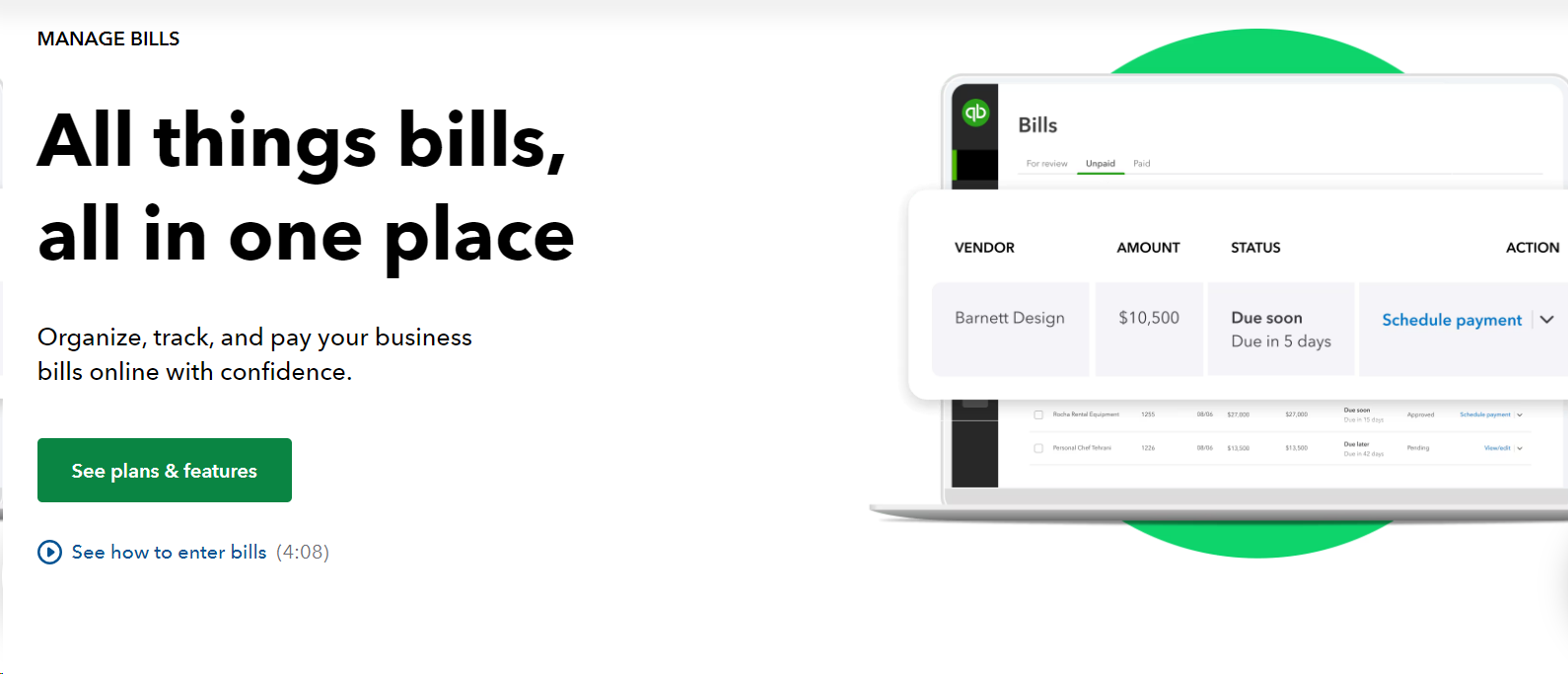

Bill Management

- Bill Tracking: Keep an eye on all your bills and their due dates so you never miss a payment.

- Payment Scheduling: With this you can schedule your payments in advance to avoid late fees.

- Vendor Management: Manage all your vendor information and track payments easily.

Bookkeeping

- Expense Tracking: Track all your business expenses and categorise them for better analysis.

- Bank Reconciliation: QuickBooks automatically imports and reconciles your bank transactions, making it easy to keep your accounts in order.

- Financial Statements: Generate accurate financial statements for tax purposes and business planning.

Cash Flow Management

- Cash Flow Forecasting: You can predict your future cash flow based on your past transactions to help you make informed financial decisions.

- Real-time Tracking: With this you can monitor your cash flow in real time.

- Budgeting Tools: Create and manage budgets to keep your expenses under control.

Cloud Accounting

- Accessibility: Access your financial data from anywhere with an internet connection.

- Automatic Updates: Get the latest features and security updates without any hassle.

- Data Security: QuickBooks uses robust security measures to protect your financial information.

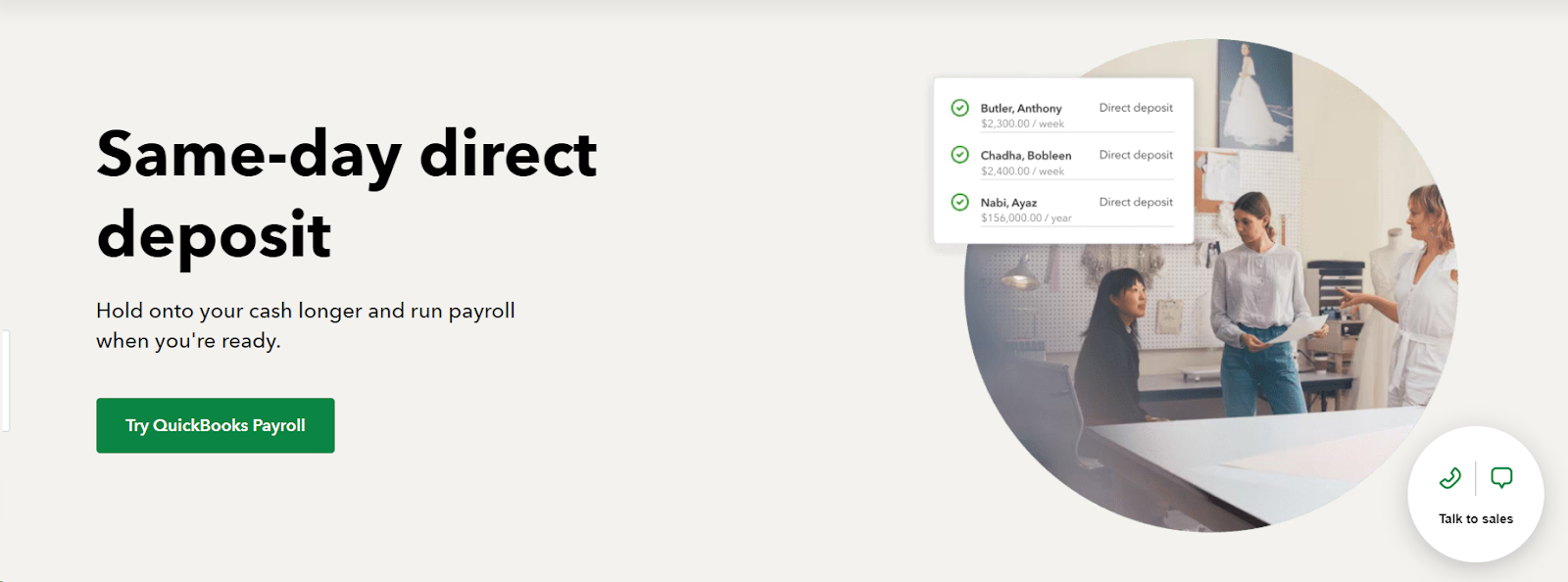

Direct Deposit

- Payroll Integration: You can automate your employee’s payments through direct deposit, that helps in saving time and reducing errors.

- Convenience: You can pay your employees directly into their bank accounts.

- Compliance: Ensure you're following all tax laws and regulations.

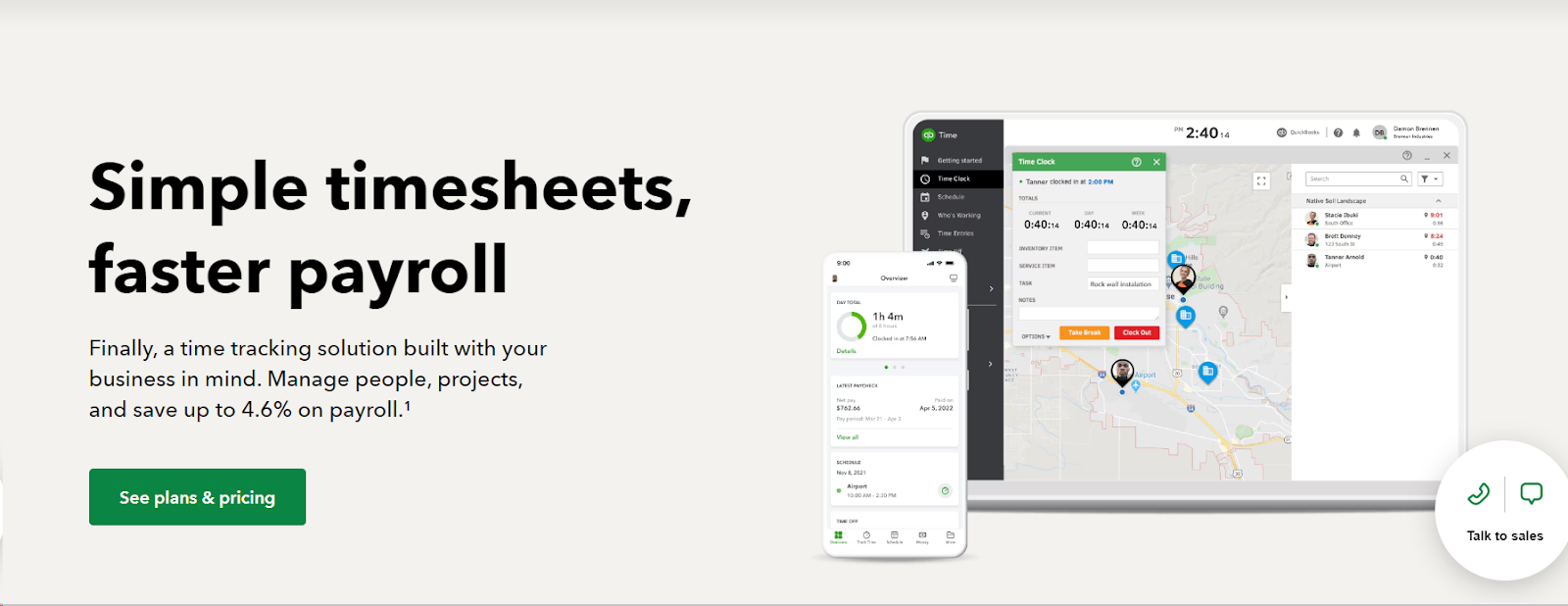

Employee Timesheets

- Time Tracking: Track your employees' hours, breaks, and overtime.

- Payroll Integration: Sync timesheets with payroll for accurate employee payments.

- Mobile Access: Employees can clock in and out using their mobile devices.

Estimates Software

- Create Estimates: Quickly generate detailed estimates and quotes for your clients.

- Convert to Invoices: Easily turn accepted estimates into invoices.

- Track Status: Keep track of the status of your estimates and follow up with clients.

Tracking Expenses

- Expense Categorization: Organise your expenses into categories for easier tracking and analysis.

- Receipt Capture: Upload and store receipts digitally.

- Expense Reports: Generate reports to monitor and manage your expenses.

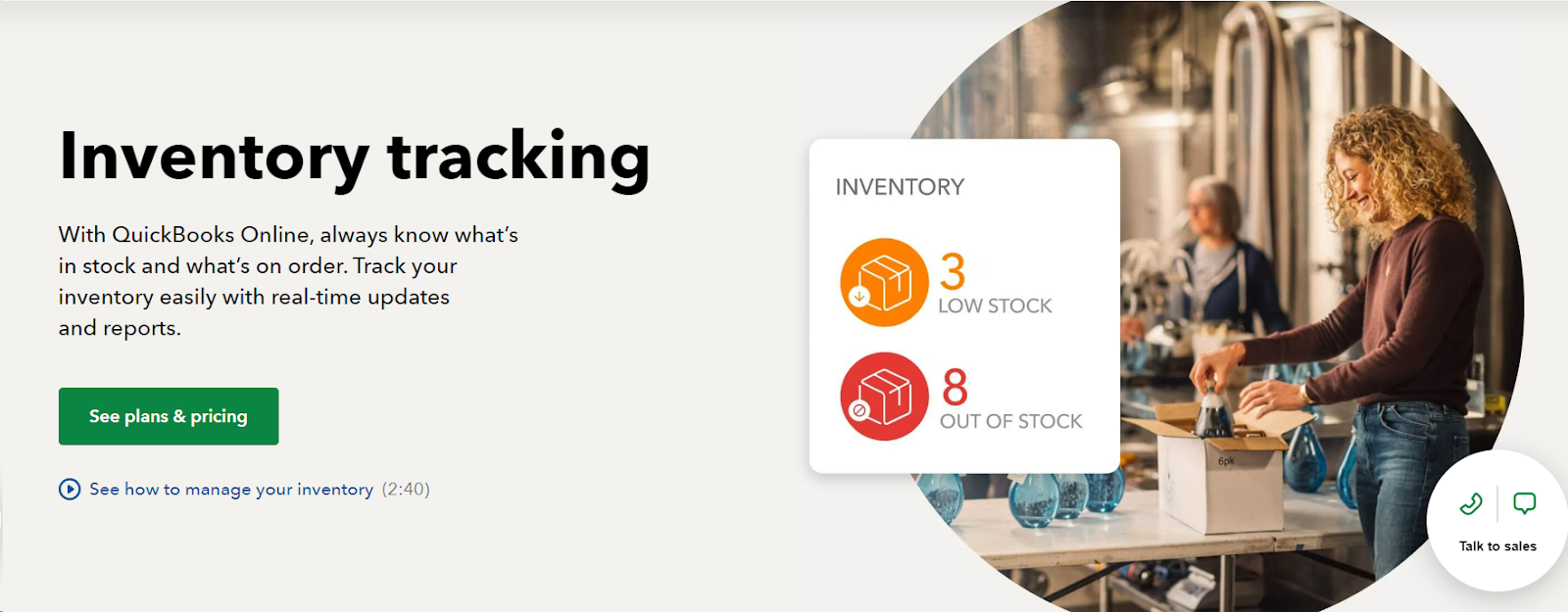

Inventory Management

- Stock Tracking: Keep an eye on your inventory levels in real time.

- Reorder Alerts: Set alerts for when your stock is running low to avoid shortages.

- Cost Tracking: Monitor the cost of goods sold and manage inventory costs effectively.

Invoicing Software

- Customizable Invoices: Create and send professional-looking invoices to your clients.

- Automated Reminders: Set up automatic reminders for overdue invoices.

- Payment Tracking: Track the status of your invoices and payments.

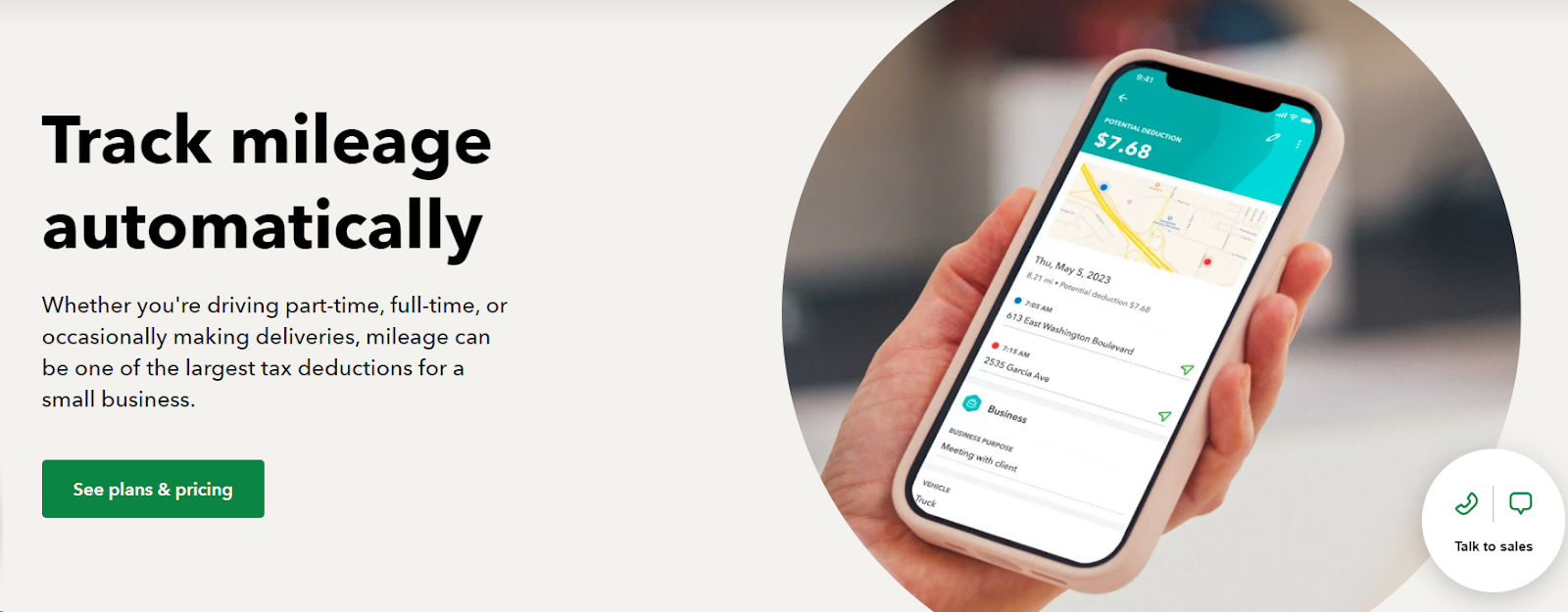

Mileage Tracker

- Automatic Tracking: Use GPS to automatically track your business mileage.

- Expense Logging: Log your mileage as a business expense for tax purposes.

- Reports: Generate mileage reports for accurate record-keeping.

Business Checking Account

- Account Integration: Link your business checking account with QuickBooks for seamless financial management.

- Transaction Tracking: Track all your transactions in one place.

- Cash Flow Management: Manage and monitor your cash flow through your linked account.

QuickBooks Integrations

- Third-Party Apps: Connect with a wide range of third-party apps to extend the functionality of QuickBooks.

- Seamless Data Transfer: Ensure smooth data transfer between QuickBooks and other software.

- Custom Workflows: Create custom workflows to streamline your business processes.

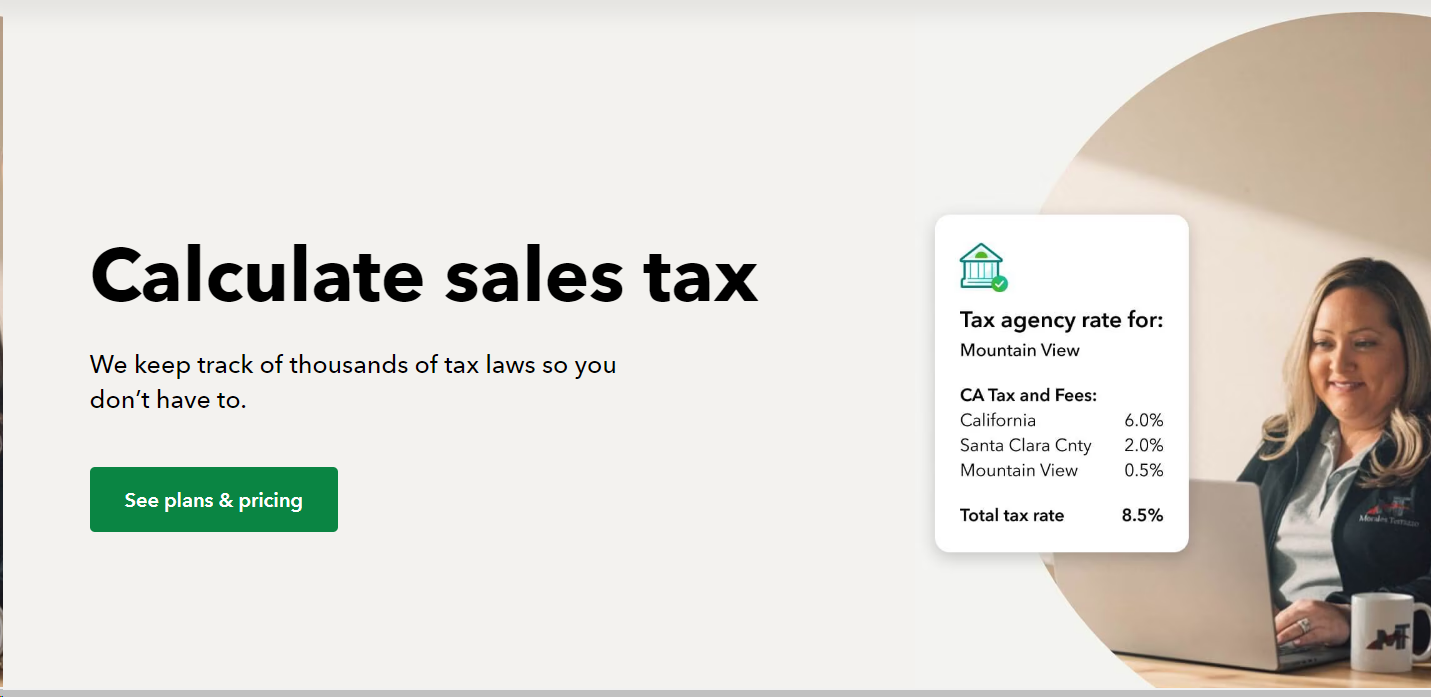

Sales Tax Software

- Automatic Calculations: Automatically calculate sales tax based on your location and transaction details.

- Tax Filing: Prepare and file your sales tax returns easily.

- Compliance: Stay compliant with state and local tax regulations.

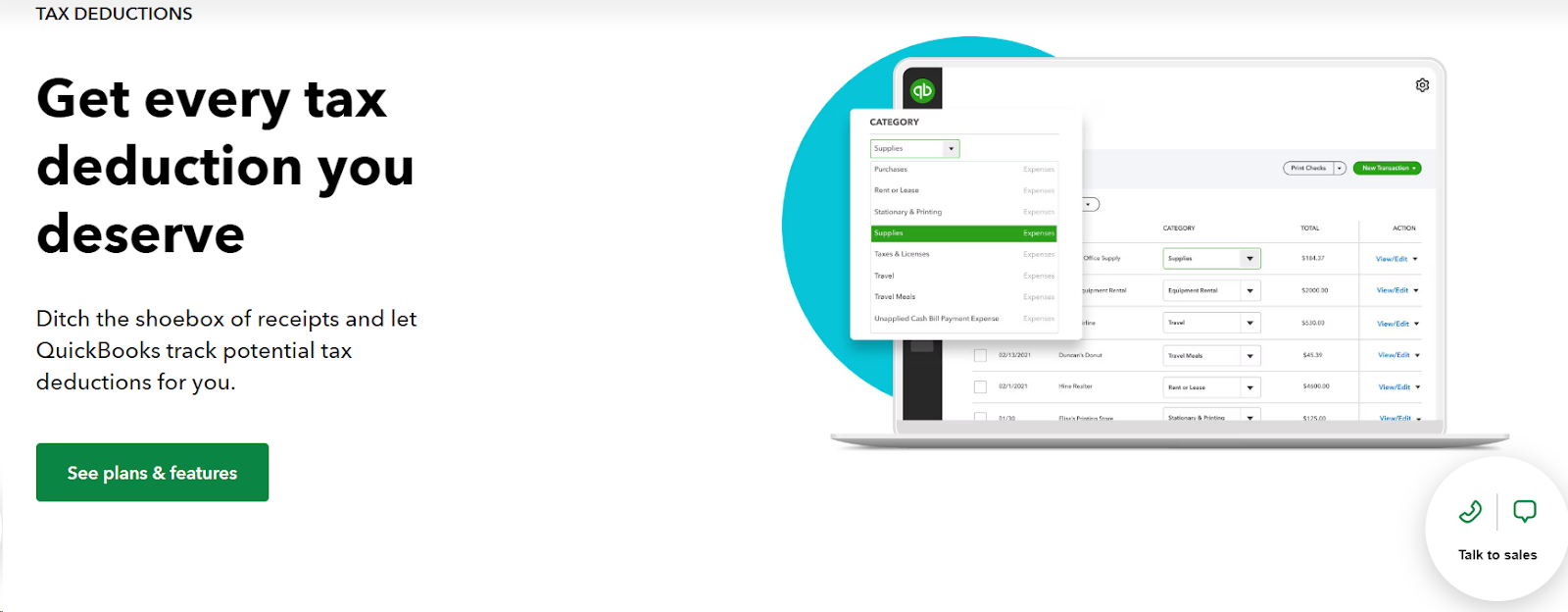

Tax Deductions

- Expense Categorization: Categorise expenses to identify tax-deductible items easily.

- Tax Reports: Generate reports to help prepare your tax returns.

- Integration with Tax Software: Connect with tax software like TurboTax for easy tax filing.

Multiple Users

- User Permissions: Assign different levels of access to multiple users in your team.

- Collaboration: Allow multiple users to work on QuickBooks simultaneously.

- Audit Trail: Track changes made by different users to ensure accountability.

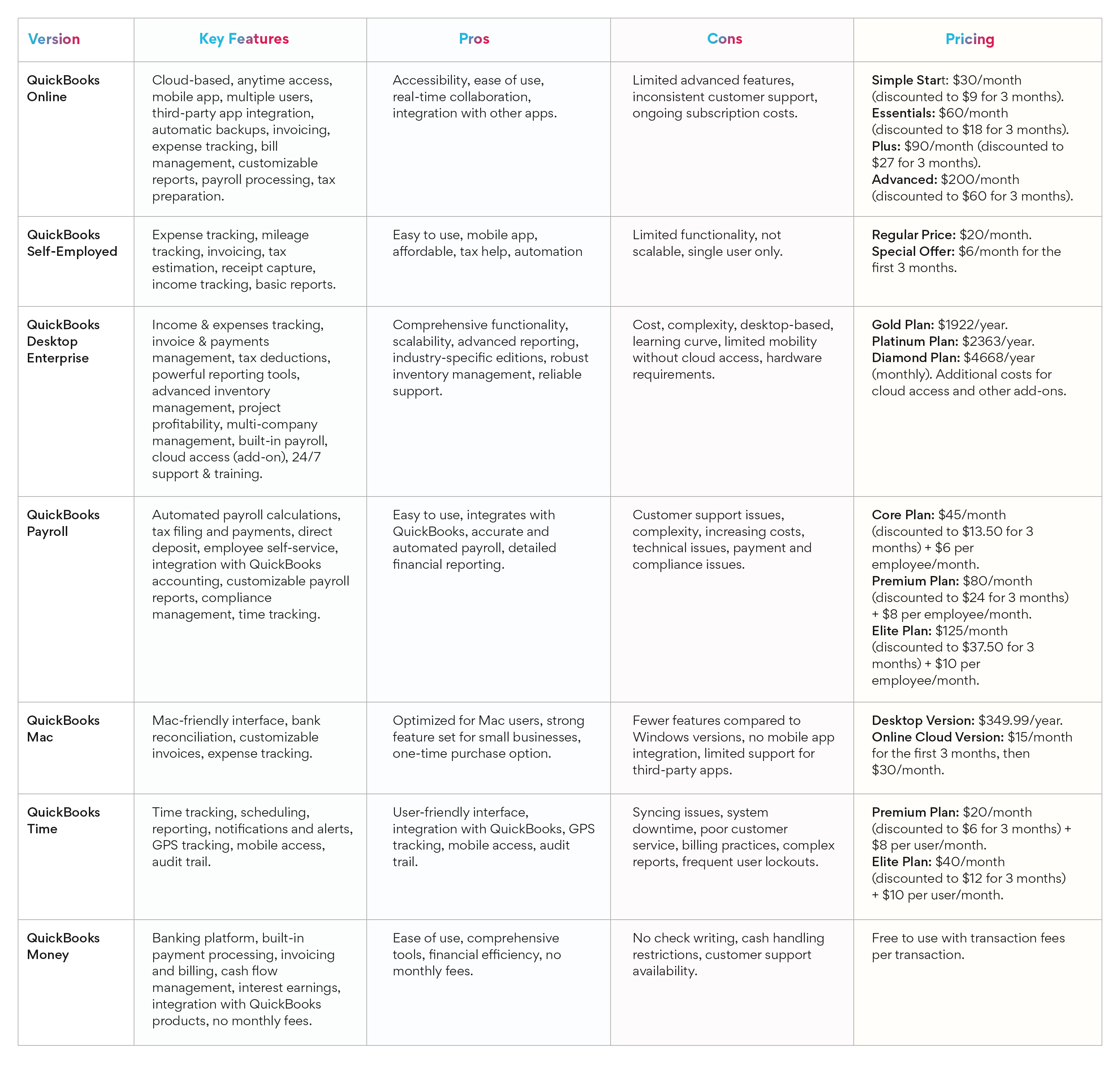

What are the different versions of Quickbooks?

Here are all the versions Quickbooks have. Let’s look at all in detail to get a better understanding on which one you must go for.

- Quickbooks Online

- Quickbooks Self Employed/ Solopreneurs

- QuickBooks Desktop Enterprise

- Quickbooks Payroll

- Quickbooks Mac

- QuickBooks Time

- Quickbooks Money

Here's a detailed table to help you understand the different versions of QuickBooks, highlighting their key features, benefits, and pricing:

This table provides a clear and concise overview of each QuickBooks version, making it easier for users to understand and skim through the information.

1. QuickBooks Online

QuickBooks Online (Quickbooks Online) is a cloud-based accounting software designed to make managing your business finances easier.

It offers a range of features and the flexibility of cloud-based access, it helps you stay organized and make informed decisions about your business.

Whether you're a small business owner, accounting agency, or self-employed, Quickbooks Online offers a variety of features to help you stay on top of your financial tasks.

Key Features of Quickbooks online:

1. Accessibility

- Anytime, Anywhere Access: You can check your accounts whenever you need to, from anywhere with an internet connection.

- Mobile App: You can manage your finances on the go with the mobile app.

2. Real-Time Collaboration

- Multiple Users: You and your team can work on Quickbooks Online at the same time, seeing the most up-to-date information.

3. Integration

- Third-Party Apps: Quickbooks Online integrates with many other apps and services, making it easier to manage your business.

- Seamless Data Transfer: No need for manual data entry as Quickbooks Online ensures smooth data transfer between different software.

4. Automatic Backups

- Data Security: Your data is automatically backed up and stored securely, so you don’t have to worry about losing important information.

5. Financial Management

- Invoicing: You can create and send professional invoices quickly, and set up recurring invoices for your regular customers.

- Expense Tracking: You can track all your business expenses by connecting your bank and credit card accounts.

- Bill Management: You can keep a track of your bills and their due dates to avoid late fees and schedule payments directly through Quickbooks Online.

6. Reporting and Analysis

- Customizable Reports: You can generate various financial reports to help you understand your business’s financial health.

- Real-Time Data: Your financial data is updated in real-time, so you always have the most current information.

7. Payroll and Employee Management

- Payroll Processing: You can automate the process of paying your employees, including calculating wages and deducting taxes.

- Employee Time Tracking: You can track your employee hours, breaks, and overtime to ensure accurate payroll processing.

8. Tax Preparation

- Sales Tax Management: Automatically calculate sales tax and prepare and file your sales tax returns.

- Tax Deductions: Keep track of tax-deductible expenses and generate reports to help during tax season. Integrate with tax software like TurboTax for easier tax filing.

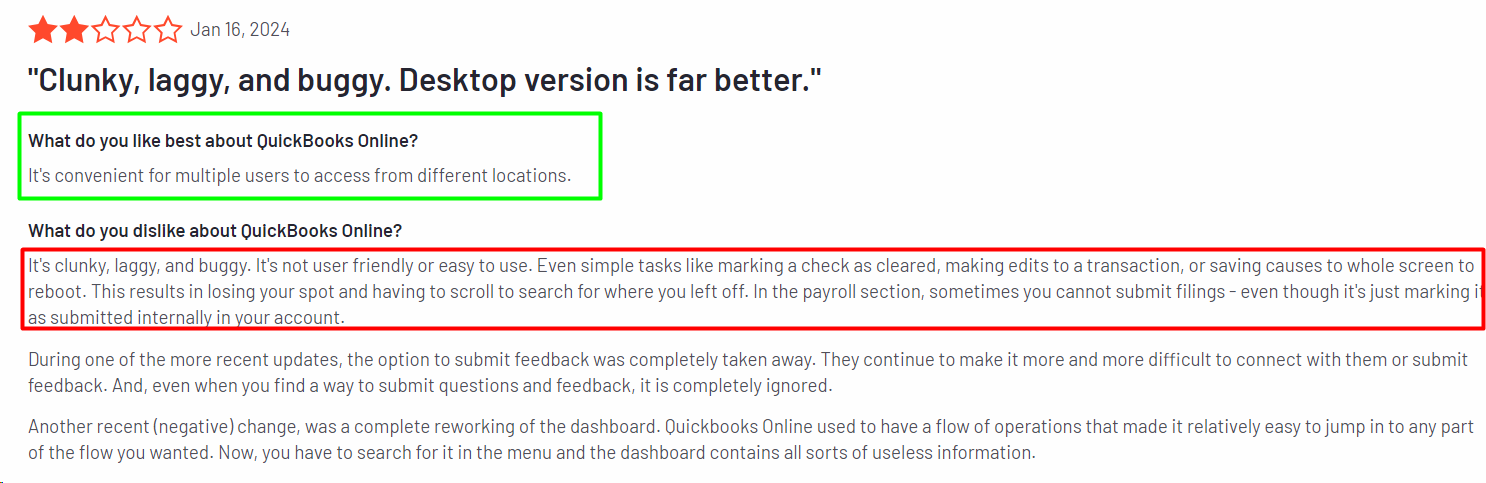

What do real users think about Quickbooks online?

Based on what QuickBooks Online's users think, let's discuss what they like and what they don't like about it. This should help you decide if it’s the right fit for your business.

Pros

1. Accessibility

- Remote Access: You can access your accounting records from anywhere with an internet connection. This is great if you travel a lot or work from different locations.

- Mobile App: With the mobile app, you can create invoices, track expenses, and capture receipts, all while on the go.

2. Ease of Use

- User-Friendly Interface: Many people find the interface straightforward and easy to navigate, especially for basic accounting tasks.

3. Integration

- Third-Party Apps: QBO integrates with many third-party apps, which can help you extend its functionality to meet your specific business needs.

- Bank and Credit Card Integration: You can automatically import and categorise transactions from your bank and credit card accounts, making reconciliation easier.

4. Financial Reporting

- Customizable Reports: You can generate various financial reports to help you understand your business’s financial health.

- Real-Time Updates: Your data is updated in real time, so you always have the latest information at your fingertips.

5. Cloud-Based

- Automatic Updates: You’ll receive the latest features and security updates automatically, without needing to install anything.

- Data Security: QBO uses strong security measures to protect your financial data.

Cons

1. Limited Features for Some Businesses

- Job Costing Issues: If your business requires detailed job costing, QBO might not meet your needs. Some users have reported difficulties with job-by-job invoicing and managing expenses tied to specific jobs.

- Complex Needs: Advanced features like detailed reporting and job tracking are not as robust as those in the desktop versions or other accounting software.

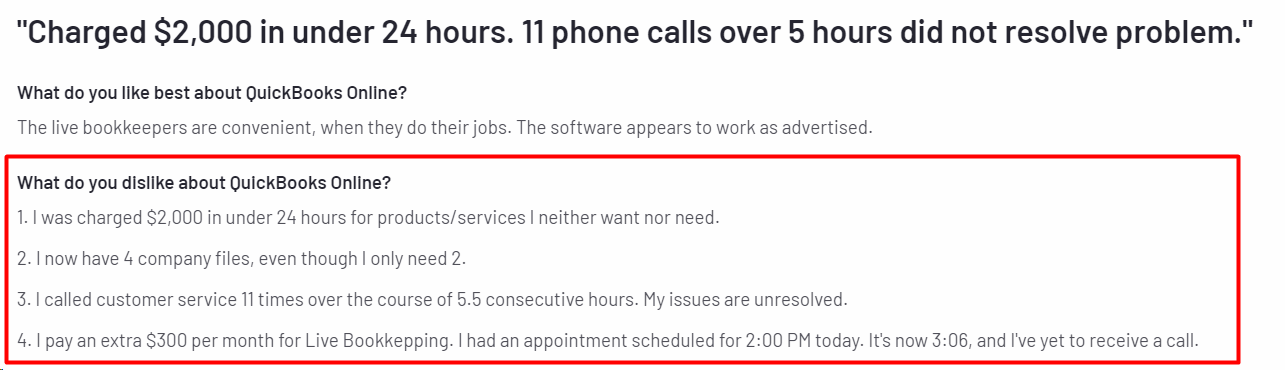

2. Customer Service

- Inconsistent Support: Many users have experienced long wait times and unhelpful customer service. Some issues require multiple calls or tickets to resolve.

- Knowledge Gaps: Sometimes, customer service representatives are not knowledgeable about the product, which can lead to frustration and wasted time.

3. Technical Problems

- Glitches and Errors: Users have reported various technical issues, such as problems with reconciliation, incorrect balances, and data discrepancies.

- Frequent Updates: While updates are necessary, they can sometimes cause compatibility issues with other software or disrupt your workflow.

4. Cost

- Expensive Over Time: While the initial cost might seem attractive, ongoing subscription fees and the need for additional features or support can add up quickly.

- Extra Charges: Additional fees for payroll, advanced features, or more users can make QBO more expensive than you initially thought.

5. Learning Curve

- Complex Setup: Setting up QBO and customising it to fit your business needs can be complex and time-consuming.

- Transition Issues: If you’re switching from desktop versions or other software, you might face challenges with data migration and learning new workflows.

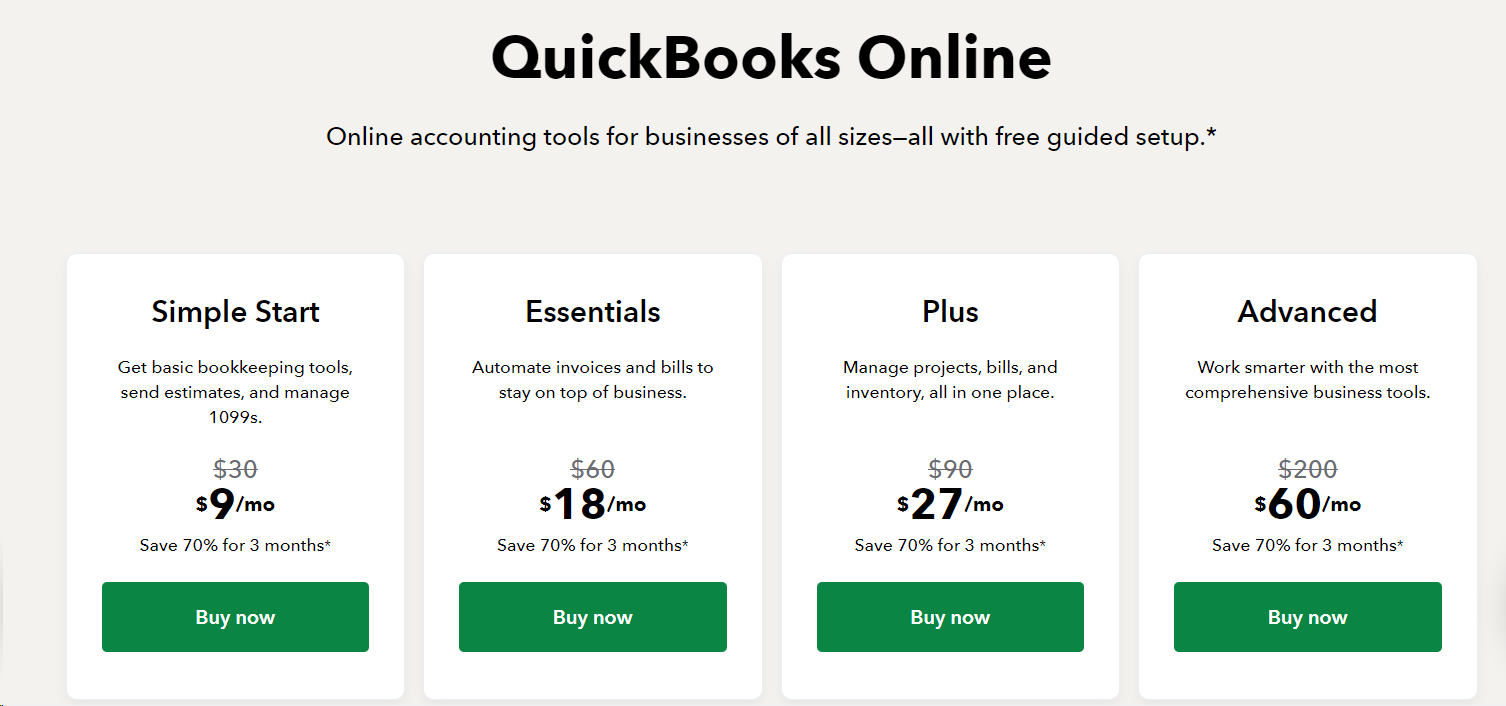

How much does Quickbooks online cost?

QuickBooks Online offers various plans to suit businesses of all sizes.

Here’s a breakdown of the different plans and their features:

1. Simple Start

- Features: Get basic bookkeeping tools, send estimates, and manage 1099s.

- Price: $30 per month, currently discounted to $9 per month for the first 3 months (Save 70%).

- Ideal For: Small businesses needing essential accounting features.

2. Essentials

- Features: Automate invoices and bills to stay on top of business operations.

- Price: $60 per month, currently discounted to $18 per month for the first 3 months (Save 70%).

- Ideal For: Businesses that need more automation for billing and invoicing.

3. Plus

- Features: Manage projects, bills, and inventory, all in one place.

- Price: $90 per month, currently discounted to $27 per month for the first 3 months (Save 70%).

- Ideal For: Businesses that need comprehensive tools for project and inventory management.

4. Advanced

- Features: Access the most comprehensive business tools for smarter work.

- Price: $200 per month, currently discounted to $60 per month for the first 3 months (Save 70%).

- Ideal For: Larger businesses needing advanced features and greater functionality.

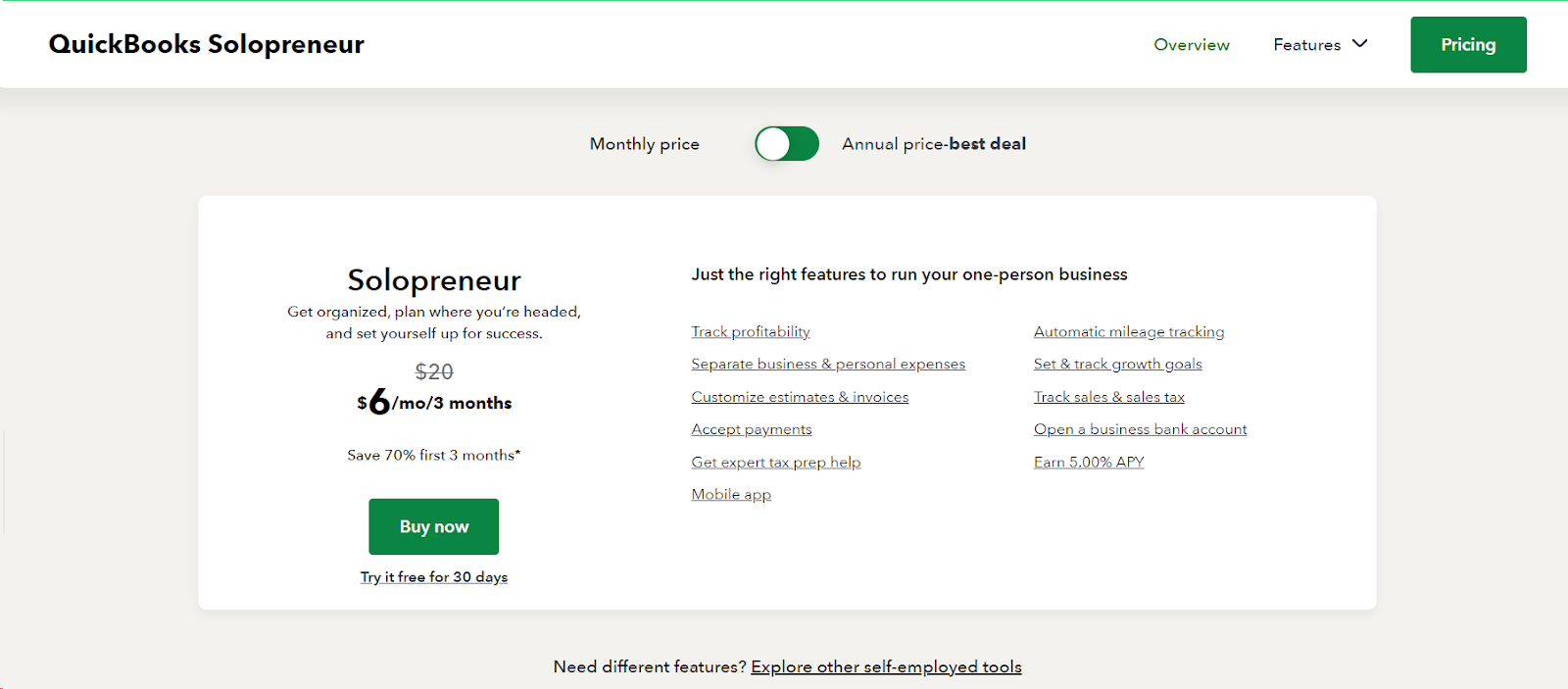

2. QuickBooks Self-Employed/ Solopreneur

If you're a solopreneur, freelancer, or self-employed individual then this version of Quickbooks is for you.

QuickBooks Self-Employed helps you keep track of your income and expenses, send invoices, and estimate your taxes.

It's designed to be super easy to use, even if you're not a numbers person.

Key Features of Quickbooks Self employed:

- Expense Tracking: Automatically sorts your expenses into categories. You can also link your bank accounts and credit cards to keep everything organised.

- Mileage Tracking: The mobile app tracks your business miles automatically, so you can get those tax deductions without any hassle.

- Invoicing: Create and send professional-looking invoices. You can even set up recurring invoices for regular clients.

- Tax Estimation: Helps you figure out how much you owe in quarterly taxes, so there are no surprises at the end of the year.

- Receipt Capture: Take photos of your receipts and attach them to your expenses. No more digging through piles of paper!

- Income Tracking: Keep track of all your income sources in one place.

- Reports: Generate basic financial reports to see how your business is doing.

Why is QuickBooks Self-Employed Great for You?

- Easy to Use:

- User-Friendly: The interface is simple and intuitive. You don't need to be a financial expert to use it.

- Mobile App: Manage your finances on the go. Track miles, capture receipts, and send invoices from anywhere.

- Tax Help:

- Tax Calculations: It helps you estimate your quarterly taxes, so you don’t end up paying too much or too little.

- Tax Deductions: Automatically finds deductions like business expenses and mileage, helping you save money.

- Affordable:

- Low Cost: QuickBooks Self-Employed is less expensive than other versions, making it a great choice if you’re watching your budget.

- Low Cost: QuickBooks Self-Employed is less expensive than other versions, making it a great choice if you’re watching your budget.

- Saves Time:

- Automation: Automates tasks like expense tracking and invoicing, so you have more time to focus on your work.

- Automation: Automates tasks like expense tracking and invoicing, so you have more time to focus on your work.

- Clear Financial Picture:

- Track Income and Expenses: Gives you a clear view of your finances, helping you budget and plan better.

A Few Downsides

- Basic Features:

- Limited Functionality: It has all the basics, but lacks some advanced features that bigger businesses might need.

- Limited Functionality: It has all the basics, but lacks some advanced features that bigger businesses might need.

- Not for Growing Businesses:

- Scalability: If your business grows, you might need to upgrade to a more advanced version of QuickBooks.

- Scalability: If your business grows, you might need to upgrade to a more advanced version of QuickBooks.

- Single User:

- One Person Only: Designed for just one user, so it's not great if you need multiple people to access the account.

How much does Quickbooks Solopreneur Cost?

Here’s its pricing:

- Regular Price: $20/month

- Special Offer: $6/month for the first 3 months (save 70%)

3. QuickBooks Desktop Enterprise

QuickBooks Desktop Enterprise is a comprehensive desktop accounting solution suitable for medium to large-sized businesses that require robust accounting and financial management tools.

Key features of Quickbooks Desktop Enterprise

- Income & Expenses Tracking:

- You can easily manage and categorize all your income and expenses. This helps you keep track of where your money is coming from and where it's going.

- You can easily manage and categorize all your income and expenses. This helps you keep track of where your money is coming from and where it's going.

- Invoice & Payments Management

- Creating and sending invoices is simple. You can also keep track of which invoices have been paid and which are still outstanding.

- Creating and sending invoices is simple. You can also keep track of which invoices have been paid and which are still outstanding.

- Tax Deductions

- The software helps you identify and maximize your tax deductions, which can save you money when tax season comes around.

- The software helps you identify and maximize your tax deductions, which can save you money when tax season comes around.

- Powerful Reporting Tools

- You get detailed reports about your finances. These reports can be customized to show exactly what you need to see.

- You get detailed reports about your finances. These reports can be customized to show exactly what you need to see.

- Advanced Inventory Management

- If you have inventory, QuickBooks Desktop Enterprise offers advanced tools to help you track and manage it efficiently.

- If you have inventory, QuickBooks Desktop Enterprise offers advanced tools to help you track and manage it efficiently.

- Project Profitability

- You can track the profitability of different projects, which is great if you work on various jobs or contracts.

- You can track the profitability of different projects, which is great if you work on various jobs or contracts.

- Multi-Company Management

- If you manage multiple companies, this feature allows you to handle all of them from one place.

- If you manage multiple companies, this feature allows you to handle all of them from one place.

- Built-In Payroll

- You can manage payroll directly within the software, making it easier to pay your employees and handle payroll taxes.

- You can manage payroll directly within the software, making it easier to pay your employees and handle payroll taxes.

- Cloud Access (Add-On)

- If you need to access your QuickBooks from anywhere, you can add cloud access.

- If you need to access your QuickBooks from anywhere, you can add cloud access.

- 24/7 Support & Training

- QuickBooks offers round-the-clock customer support and training resources, so you can get help whenever you need it.

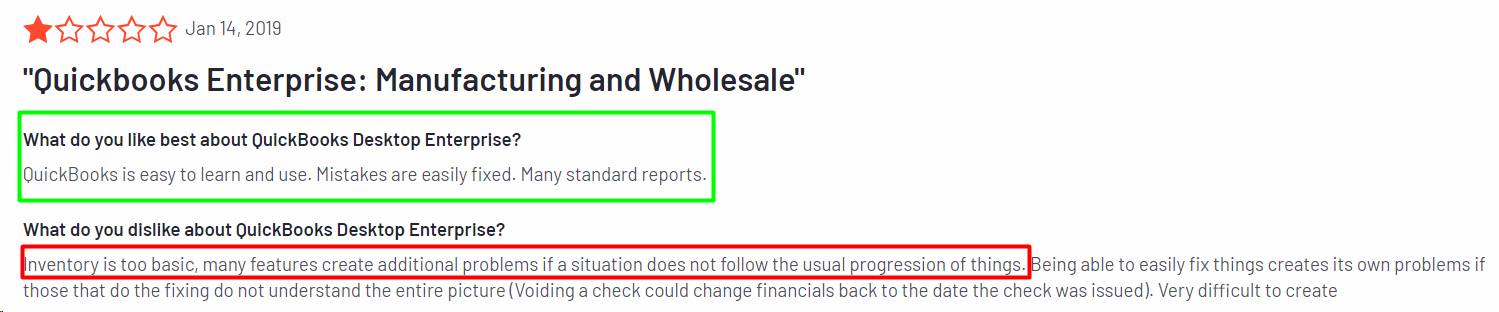

What do real users think about Quickbooks Desktop Enterprise?

Let’s discuss what users like and dislike about this version of Quickbooks:

Pros

- Comprehensive Functionality

- QuickBooks Desktop Enterprise has many features that cover all aspects of accounting, inventory management, payroll, and reporting. It's very thorough.

- QuickBooks Desktop Enterprise has many features that cover all aspects of accounting, inventory management, payroll, and reporting. It's very thorough.

- Scalability

- This software can support up to 40 users. If your business is growing, this could be very useful.

- This software can support up to 40 users. If your business is growing, this could be very useful.

- Advanced Reporting

- The reporting tools are powerful and allow for detailed financial analysis. You can customise reports to meet your specific needs.

- The reporting tools are powerful and allow for detailed financial analysis. You can customise reports to meet your specific needs.

- Industry-Specific Editions

- There are versions of the software tailored for different industries, like manufacturing, retail, and nonprofits.

- There are versions of the software tailored for different industries, like manufacturing, retail, and nonprofits.

- Robust Inventory Management

- The advanced inventory management features help you keep track of stock levels and streamline operations.

- The advanced inventory management features help you keep track of stock levels and streamline operations.

- Multi-Company Management

- If you have more than one company, you can manage all of them in one place.

- If you have more than one company, you can manage all of them in one place.

- Reliable Support

- With 24/7 customer support and extensive training resources, you can get help whenever you need it.

Cons

- Cost

- QuickBooks Desktop Enterprise is more expensive upfront and has ongoing subscription costs. This might be too high for smaller businesses.

- QuickBooks Desktop Enterprise is more expensive upfront and has ongoing subscription costs. This might be too high for smaller businesses.

- Complexity

- There are many features, which can be overwhelming if you're new to accounting software or if your business needs are simple.

- There are many features, which can be overwhelming if you're new to accounting software or if your business needs are simple.

- Desktop-Based

- Since it’s a desktop solution, you need to install it on a local computer. It doesn’t offer the same flexibility as cloud-based solutions unless you add cloud access.

- Since it’s a desktop solution, you need to install it on a local computer. It doesn’t offer the same flexibility as cloud-based solutions unless you add cloud access.

- Learning Curve

- It can take time to learn how to use all the advanced features and customization options.

- It can take time to learn how to use all the advanced features and customization options.

- Limited Mobility

- Without the cloud access add-on, you can only use it on the computer where it's installed.

- Without the cloud access add-on, you can only use it on the computer where it's installed.

- Hardware Requirements

- You need a compatible computer, which might mean additional costs if your current setup isn’t adequate.

How much does Quickbooks Desktop Enterprise cost?

QuickBooks Desktop Enterprise offers different subscription plans with various features to cater to your business needs. Here’s a detailed look at the pricing and key features for each plan:

Gold Plan

- Price: $1922 for the first year

- Subscription: Annual

- Key Features:

- QuickBooks Desktop Enterprise software

- Supports up to 30 users with custom roles and permissions

- Advanced Reporting

- QuickBooks Priority Circle

- QuickBooks Desktop Enhanced Payroll

Platinum Plan

- Price: $2363 for the first year

- Subscription: Annual

- Key Features:

- All features of the Gold Plan, plus:

- Advanced Inventory

- Advanced Pricing

- Bill & PO workflow approvals

Diamond Plan

- Price: $4668 for the first year

- Subscription: Monthly

- Key Features:

- All features of the Platinum Plan, plus:

- Supports up to 40 users with custom roles and permissions

- QuickBooks Desktop Assisted Payroll (additional $1 per pay period per employee fee)

- QuickBooks Time Elite (additional $5 per month per employee fee)

- Salesforce CRM connector (optional add-on, $150 per month + one-time onboarding fee)

4. QuickBooks Payroll

QuickBooks Payroll is a payroll management service offered by Intuit.

It’s designed to help businesses automate and streamline their payroll processes. With QuickBooks Payroll, you can handle everything from calculating employee wages to filing payroll taxes, all within the same platform.

QuickBooks Payroll integrates with QuickBooks Online or Desktop to manage payroll functions.

Key Features Of Quickbooks Payroll

Automated Payroll Calculations

- QuickBooks Payroll automatically calculates your employees' wages, including deductions for taxes, insurance, and other benefits. This reduces the risk of manual errors and saves time.

Tax Filing and Payments

- The service calculates federal, state, and local payroll taxes and can file these taxes for you. It also ensures that payments are made on time, helping you stay compliant with tax regulations.

Direct Deposit

- You can pay your employees through direct deposit, which is a convenient and fast way to ensure they get their paychecks on time.

Employee Self-Service

- Employees can access their pay stubs, W-2s, and other payroll information online. This reduces the administrative burden on your HR department.

Integration with QuickBooks Accounting

- QuickBooks Payroll integrates seamlessly with QuickBooks accounting software. This means your payroll data is automatically synced with your financial records, making bookkeeping easier.

Customizable Payroll Reports

- The software provides a variety of payroll reports that can be customized to meet your specific needs. These reports help you keep track of your payroll expenses and make informed business decisions.

Compliance Management

- QuickBooks Payroll helps you stay compliant with federal and state labour laws by keeping you updated on regulatory changes and ensuring your payroll practices are in line with current laws.

Time Tracking

- With additional integrations like TSheets by QuickBooks, you can track employee hours more accurately, which is especially useful for businesses with hourly workers.

What do real users think about Quickbooks payroll?

If you're considering using QuickBooks Payroll, let's have a little chat about what you might like and what could be a bit frustrating. I'll keep it simple and clear so you can make the best decision for your business.

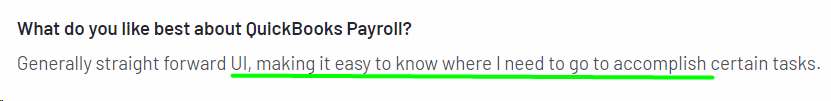

Pros

- Easy to Use and Understand

- What You'll Like: The user interface (UI) is pretty straightforward. It’s easy to know where you need to go to get things done. Setting up and configuring QuickBooks Payroll is a breeze, so you won’t spend ages getting started.

- Why It Matters: This is great because you won’t waste time figuring out how to use it. You can focus on running your business instead of learning a complicated system.

- Works Well with Other QuickBooks Products

- What You'll Like: If you already use QuickBooks for accounting, you’ll love how smoothly QuickBooks Payroll integrates with it. This means all your financial data is in one place, making it easier to manage.

- Why It Matters: This integration saves you from the hassle of switching between different systems. Everything works together, making your job simpler.

- What You'll Like: If you already use QuickBooks for accounting, you’ll love how smoothly QuickBooks Payroll integrates with it. This means all your financial data is in one place, making it easier to manage.

- Accurate and Automated

- What You'll Like: QuickBooks Payroll automatically calculates payroll taxes and deductions. This includes federal, state, and local taxes, as well as things like 401(k) contributions and health insurance premiums.

- Why It Matters: Automation means fewer mistakes and less manual work for you. You can trust that calculations are correct, which is a big relief.

- What You'll Like: QuickBooks Payroll automatically calculates payroll taxes and deductions. This includes federal, state, and local taxes, as well as things like 401(k) contributions and health insurance premiums.

- Detailed Financial Reporting

- What You'll Like: The software provides strong financial reporting. This helps you understand your business finances better and make informed decisions.

- Why It Matters: Good reports are essential for planning and managing your business effectively. It’s especially useful during tax season or when reporting to stakeholders.

- What You'll Like: The software provides strong financial reporting. This helps you understand your business finances better and make informed decisions.

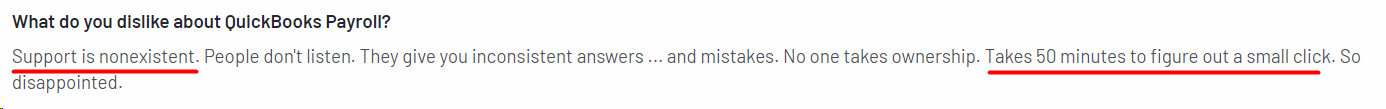

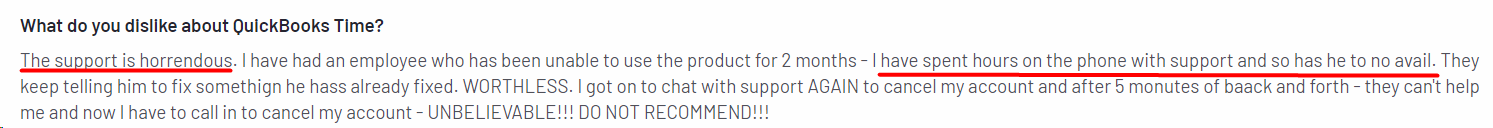

Cons

- Customer Support Issues

- What You Might Not Like: Many users find customer support to be poor. You might face long wait times, unhelpful answers, or get disconnected from chats.

- Why It's Frustrating: When you need help, you want quick and clear answers. Bad support can leave you stuck with unresolved issues, wasting your time and causing stress.

- Complex and Hard to Navigate

- What You Might Not Like: Some users find QuickBooks Payroll complicated, especially if they’re new to payroll processing. The reports can be hard to understand if you’re not an accountant.

- Why It's Frustrating: A steep learning curve means you spend more time trying to figure things out instead of running your business. It can be particularly tough if you don’t have an accounting background.

- What You Might Not Like: Some users find QuickBooks Payroll complicated, especially if they’re new to payroll processing. The reports can be hard to understand if you’re not an accountant.

- Increasing Costs

- What You Might Not Like: The price of QuickBooks Payroll has gone up a lot over time. It can get quite expensive, especially for small businesses.

- Why It's Frustrating: Higher costs can strain your budget. You want good value for your money, and steep prices can make you rethink if it’s worth it.

- What You Might Not Like: The price of QuickBooks Payroll has gone up a lot over time. It can get quite expensive, especially for small businesses.

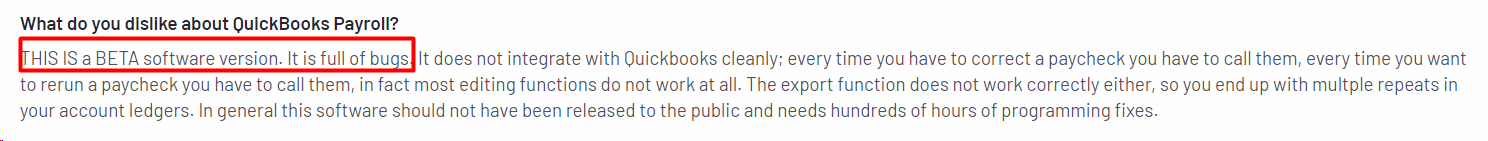

- Technical Issues and Bugs

- What You Might Not Like: Users report frequent technical issues, like slow loading times and system hang-ups. Sometimes, the software doesn’t work as smoothly as it should.

- Why It's Frustrating: Technical problems can interrupt your work and waste your time. You expect software to make things easier, not harder.

- Limited Functionality Updates

- What You Might Not Like: QuickBooks Payroll doesn’t always improve features unless a lot of users ask for it. Some useful features from older versions might be missing.

- Why It's Frustrating: If you need specific features that aren’t available, it can limit how effectively you use the software. Missing features can be a big drawback.

- What You Might Not Like: QuickBooks Payroll doesn’t always improve features unless a lot of users ask for it. Some useful features from older versions might be missing.

- Payment and Compliance Issues

- What You Might Not Like: Some users have faced issues with missed payments to state departments and errors in registration.

- Why It's Frustrating: Compliance issues can lead to penalties and extra stress. You need reliable software to handle these important tasks correctly.

- What You Might Not Like: Some users have faced issues with missed payments to state departments and errors in registration.

- Data Loss and Transition Problems

- What You Might Not Like: Moving from older versions of the software can cause data loss. You might lose access to previous reports and employee records.

- Why It's Frustrating: Losing important data can disrupt your business operations. It’s a hassle to recover lost information and affects your workflow.

- What You Might Not Like: Moving from older versions of the software can cause data loss. You might lose access to previous reports and employee records.

How much does quickbooks Payroll cost?

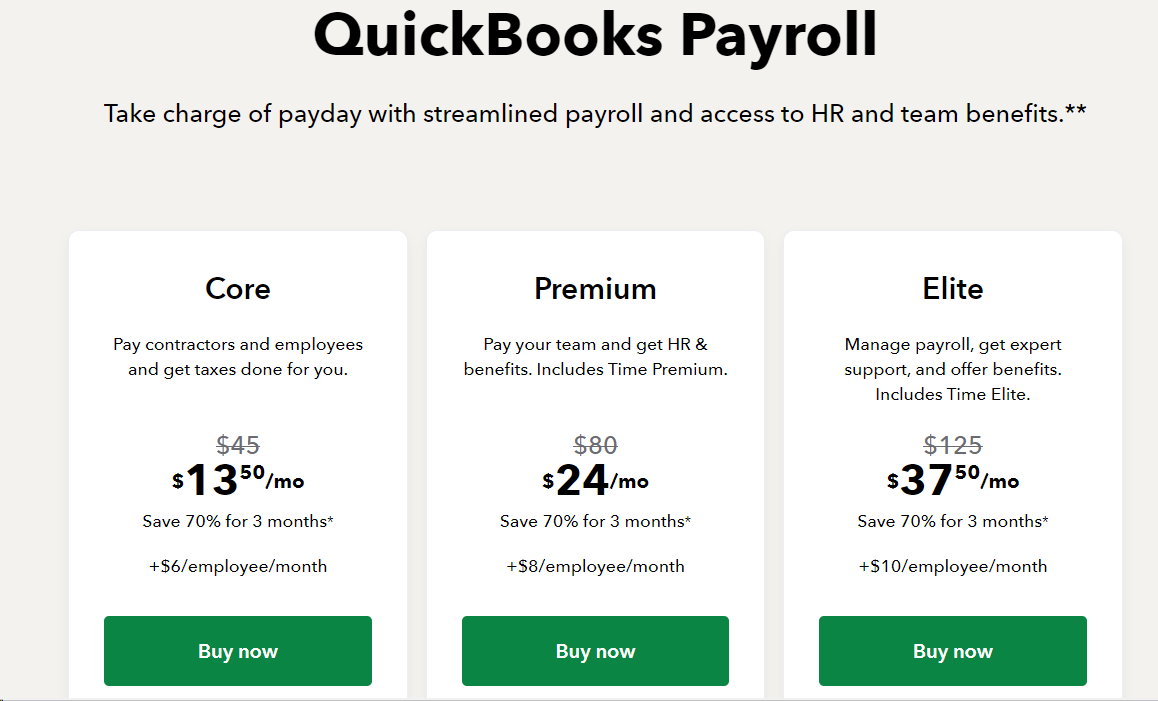

QuickBooks Payroll offers three different plans to cater to various business needs: Core, Premium, and Elite. Each plan provides a range of features to help you manage payroll efficiently.

Here’s a breakdown of the pricing and what each plan includes:

Core Plan

- Price:

- Standard: $45 per month

- Discounted: $13.50 per month for the first 3 months (70% savings)

- Additional Cost: +$6 per employee per month

- Features:

- Pay contractors and employees

- Automatic payroll tax calculations and filings

- Direct deposit for employees

Premium Plan

- Price:

- Standard: $80 per month

- Discounted: $24 per month for the first 3 months (70% savings)

- Additional Cost: +$8 per employee per month

- Features:

- All Core Plan features

- Access to HR support and benefits

- Includes Time Premium for time tracking

Elite Plan

- Price:

- Standard: $125 per month

- Discounted: $37.50 per month for the first 3 months (70% savings)

- Additional Cost: +$10 per employee per month

- Features:

- All Premium Plan features

- Priority support with payroll experts

- Enhanced HR support and benefits

- Includes Time Elite for advanced time tracking

5. QuickBooks Mac

If you're a Mac user and looking for accounting software, let me tell you about QuickBooks Mac. It's made especially for people like you who use Mac computers and comes with many of the same features as QuickBooks Desktop. Let's dive into what it offers and how it can help you with your accounting needs.

Key Features

- Mac-friendly Interface: This means the software is designed to work smoothly with your Mac OS. You won't have to struggle with compatibility issues.

- Bank Reconciliation: You can easily match your bank statements with your accounting records, making sure everything is accurate and up to date.

- Customizable Invoices: Want to send professional-looking invoices? QuickBooks Mac lets you create and send invoices that look great and are easy to customize.

- Expense Tracking: Keeping track of your expenses is a breeze. You can categorize your spending, so you know exactly where your money is going.

What users like and dislike the most about Quickbooks Mac?

Let's talk about the good and the not-so-good parts of QuickBooks Mac.

Pros:

- Optimized for Mac Users: It's designed just for you, making it easy to use on a Mac.

- Strong Feature Set for Small Businesses: It has a lot of features that small business owners will find very useful.

- One-time Purchase Option: You can buy it once and use it, instead of paying monthly or yearly.

Cons:

- Fewer Features Compared to Windows Versions: It doesn't have as many features as the QuickBooks version for Windows.

- No Mobile App Integration: You can't use it with a mobile app, which might be a downside if you like managing your finances on the go.

- Limited Support for Third-Party Apps: It doesn't work well with many other apps, so you might find it less flexible if you rely on other software.

How much does Quickbooks for Mac cost?

Purchase Options for QuickBooks for Mac

- Desktop Version:

- Annual Licensing Fee: $349.99 per year

- This version is installed on your computer and includes all the features needed for managing your accounting tasks.

- Online Cloud Version:

- Initial Pricing: $15 per month for the first three months

- Regular Pricing: $30 per month after the first three months

- This version allows you to access QuickBooks from anywhere with an internet connection, offering the flexibility of cloud-based accounting.

6. QuickBooks Time (formerly TSheets)

Let's talk about QuickBooks Time and how it can help you manage your business. QuickBooks Time, which used to be called TSheets, is a tool that helps you track your employees' work hours.

It's especially useful if you need to keep a close eye on time for payroll, project management, or billing.

Key Features of QuickBooks Time

- Time Tracking:

- QuickBooks Time lets your employees clock in and out using their computers or mobile phones. This means you can track their work hours accurately, whether they’re in the office or working remotely.

- QuickBooks Time lets your employees clock in and out using their computers or mobile phones. This means you can track their work hours accurately, whether they’re in the office or working remotely.

- Scheduling:

- You can create and manage employee schedules right in QuickBooks Time. Assign shifts, notify employees of changes, and make sure you have the right coverage for all your tasks.

- You can create and manage employee schedules right in QuickBooks Time. Assign shifts, notify employees of changes, and make sure you have the right coverage for all your tasks.

- Reporting:

- QuickBooks Time offers various reports that help you see labor costs, project hours, and other important details. You can customize these reports and export them if needed.

- QuickBooks Time offers various reports that help you see labor costs, project hours, and other important details. You can customize these reports and export them if needed.

- Notifications and Alerts:

- Set up reminders for your employees to clock in or out, take breaks, or submit their timesheets. This reduces missed punches and helps you comply with labor laws.

Now if you're thinking about using QuickBooks Time, or maybe you already do, let’s have a straightforward chat about what you can expect.

We’ll look at both the good and the not-so-good, so you have a clear picture of what this tool can do for you.

What’s Great About QuickBooks Time?

- User-Friendly Interface:

- You'll find that the interface is pretty intuitive. Setting up new companies and adding employees is quick and simple, which can save you a lot of time.

- You'll find that the interface is pretty intuitive. Setting up new companies and adding employees is quick and simple, which can save you a lot of time.

- Integration with QuickBooks:

- One of the standout features is how it integrates directly with QuickBooks. This means you can easily import time tracking data into your accounting software.

- One of the standout features is how it integrates directly with QuickBooks. This means you can easily import time tracking data into your accounting software.

- GPS Tracking:

- If you need to know where your team is working, the GPS tracking feature is really handy. It helps you see your team's locations and ensures they are where they should be.

- Mobile Access:

- You and your team can log in using phones or computers. This flexibility makes it easier to track time no matter where you are.

- You and your team can log in using phones or computers. This flexibility makes it easier to track time no matter where you are.

- Audit Trail:

- QuickBooks Time is DCAA compliant, which means it has a good audit trail. This is crucial if you need to meet certain regulatory requirements.

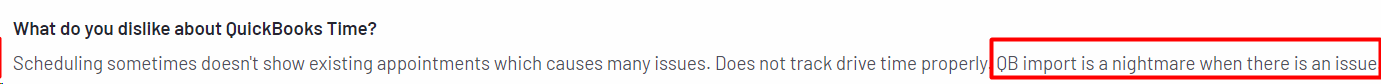

What’s Not So Great About QuickBooks Time?

- Syncing Issues:

- Many users face problems with syncing QuickBooks Time with QuickBooks Online. This can disrupt your work and cause inaccuracies in your data.

- Many users face problems with syncing QuickBooks Time with QuickBooks Online. This can disrupt your work and cause inaccuracies in your data.

- System Downtime:

- Sometimes, QuickBooks Time goes down unexpectedly, making it impossible to log in or track time. This can be quite frustrating when you need it the most.

- Customer Service:

- The customer service isn’t great. You might experience long wait times, unhelpful responses, and frequent disconnections if you don’t respond quickly during a chat session.

- Billing Practices:

- Be careful with the billing. Some users feel they’ve been overcharged, especially when signing up for yearly plans. There have been instances of unexpected fee increases without proper notification.

- Be careful with the billing. Some users feel they’ve been overcharged, especially when signing up for yearly plans. There have been instances of unexpected fee increases without proper notification.

- Complex Reports:

- If you need to customize reports, you might find it difficult. Often, you’ll have to download the reports to Excel and manually adjust them.

- If you need to customize reports, you might find it difficult. Often, you’ll have to download the reports to Excel and manually adjust them.

- Frequent User Lockouts:

- Users often get locked out without any clear reason, requiring password resets. This is inconvenient and can slow down your work.

- Users often get locked out without any clear reason, requiring password resets. This is inconvenient and can slow down your work.

- Software Bugs:

- The software has bugs. These issues range from login problems to data not syncing correctly, causing significant disruptions.

- The software has bugs. These issues range from login problems to data not syncing correctly, causing significant disruptions.

- Forced Integrations:

- When Intuit acquired TSheets and turned it into QuickBooks Time, they forced an integration with QuickBooks. This has caused problems, like creating duplicate client entries and unnecessary accounts.

How much does Quickbooks Time cost?

QuickBooks Time offers two main plans: Premium and Elite. Each plan comes with different features and costs, so you can pick the one that suits your business best.

Premium Plan

- What You Get:

- With the Premium plan, you can easily track the time and attendance of your team, no matter where they are working.

- This plan includes basic time tracking features, mobile access, and some reporting tools.

- Cost:

- The regular price is $20 per month.

- For the first three months, you can get a 70% discount, bringing the cost down to $6 per month.

- There is an additional charge of $8 per user per month.

- Example: If you have 5 employees, the monthly cost for the first three months would be $6 + (5 x $8) = $46 per month. After three months, it would be $20 + (5 x $8) = $60 per month.

Elite Plan

- What You Get:

- The Elite plan includes everything in the Premium plan plus additional features for real-time project collaboration and advanced time tracking.

- This plan is designed to help you meet deadlines with better project management tools.

- Cost:

- The regular price is $40 per month.

- For the first three months, you can get a 70% discount, bringing the cost down to $12 per month.

- There is an additional charge of $10 per user per month.

- Example: If you have 5 employees, the monthly cost for the first three months would be $12 + (5 x $10) = $62 per month. After three months, it would be $40 + (5 x $10) = $90 per month.

7. QuickBooks Money

QuickBooks Money is a financial management solution offered by Intuit, specifically designed for small and medium-sized businesses.

Key Features of Quickbooks Money

- Banking Platform

- QuickBooks Money acts as your business bank account. You can set money aside and earn interest on it when it’s just sitting there. This provides a way to save while keeping funds accessible.

- QuickBooks Money acts as your business bank account. You can set money aside and earn interest on it when it’s just sitting there. This provides a way to save while keeping funds accessible.

- Built-in Payment Processing

- QuickBooks Money allows you to pay vendors or get paid by clients all in one place. The funds are available the same day, so there’s no more waiting around for your money.

- QuickBooks Money allows you to pay vendors or get paid by clients all in one place. The funds are available the same day, so there’s no more waiting around for your money.

- Invoicing and Billing

- Sending invoices and tracking payments can be a hassle. QuickBooks Money simplifies this by letting you create invoices, send them to clients, and keep track of who owes you money all within the app.

- Sending invoices and tracking payments can be a hassle. QuickBooks Money simplifies this by letting you create invoices, send them to clients, and keep track of who owes you money all within the app.

- Cash Flow Management

- Managing cash flow can be tricky. With QuickBooks Money, you can schedule bill payments in advance. This way, you avoid late fees and ensure everything gets paid on time, helping you maintain smooth operations.

- Managing cash flow can be tricky. With QuickBooks Money, you can schedule bill payments in advance. This way, you avoid late fees and ensure everything gets paid on time, helping you maintain smooth operations.

- Interest Earnings

- You can earn up to 5% interest on the money you set aside. This allows your idle cash to work for you, adding an extra benefit to your savings.

- You can earn up to 5% interest on the money you set aside. This allows your idle cash to work for you, adding an extra benefit to your savings.

- Integration with QuickBooks Products

- If you’re already using other QuickBooks products, QuickBooks Money integrates seamlessly with them, providing a unified financial management experience.

- If you’re already using other QuickBooks products, QuickBooks Money integrates seamlessly with them, providing a unified financial management experience.

- No Monthly Fees

- QuickBooks Money doesn’t charge any monthly fees, which helps keep your costs down and makes it an economical choice for financial management.

- QuickBooks Money doesn’t charge any monthly fees, which helps keep your costs down and makes it an economical choice for financial management.

- Customer Support

- QuickBooks Money offers customer support during weekdays. If you have questions or run into issues, support is available to help you out.

- QuickBooks Money offers customer support during weekdays. If you have questions or run into issues, support is available to help you out.

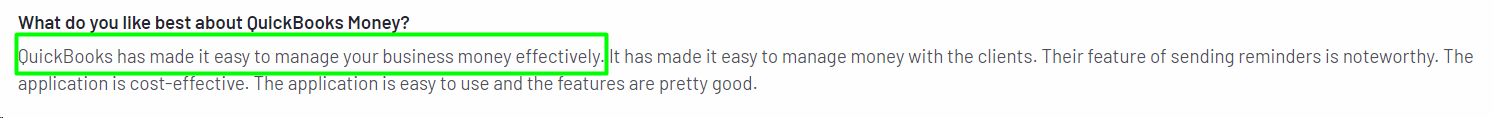

What’s great about Quickbooks money?

- Ease of Use: QuickBooks Money is user-friendly and designed for people who may not have extensive accounting knowledge.

- Comprehensive Tools: It offers a range of financial tools covering invoicing, payments, and cash flow management.

- Financial Efficiency: You can manage your money more efficiently by earning interest on funds and using integrated tools.

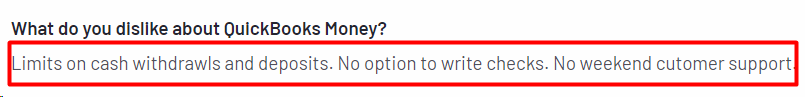

What’s not so great about Quickbooks money?

- No Check Writing: QuickBooks Money does not support check writing, which can be a drawback if your business relies on checks.

- Cash Handling Restrictions: There are limits on cash withdrawals and deposits, which can be restrictive for frequent cash transactions.

- Customer Support Availability: Customer support is not available on weekends, which can be inconvenient if you need help outside regular business hours.

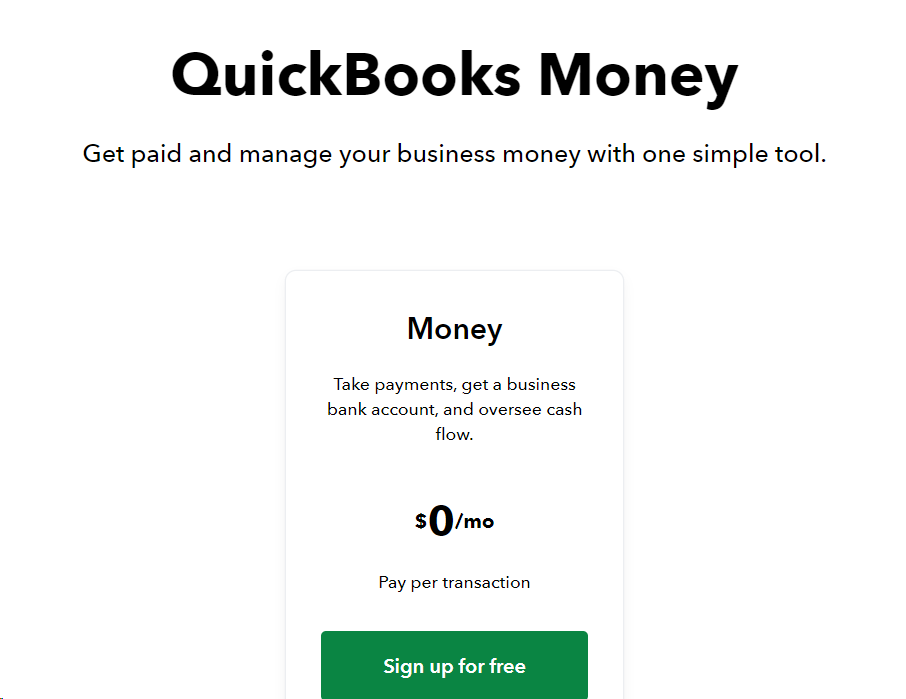

How much does Quickbooks Money cost?

QuickBooks Money is free to use in terms of having no monthly subscription fee. However, while there is no cost to access and use the basic features, there are transaction fees that you will need to pay when you take payments.

This means that while you don’t have to pay a monthly fee, you will incur costs based on the transactions you process through the platform.

Pricing:

- Monthly Cost: $0 per month

- Transaction Fees: Pay per transaction

Now with all the pros and cons of these Quickbooks all versions work, don’t you think it’ll be great if Quickbooks works a little better? I do!

If you're an accountant,

you know how challenging it can be to close the monthly or yearly financials.

The process often involves sorting through large amounts of data, correcting errors, and ensuring everything is accurate.

This can be particularly difficult when using QuickBooks Online for month-end or year-end close, as the data cleaning process can take up a lot of your time.

One common issue is dealing with discrepancies in financial reports. These discrepancies can lead to delays and make it hard to meet deadlines.

Additionally, ensuring that all transactions are correctly categorized and reconciled can be a tedious task.

To help with these problems, we have launched Xenett.

Xenett is designed to streamline the data cleaning process in QuickBooks, making it faster and more efficient.

It helps identify and correct errors, ensuring your financial data is accurate and up-to-date.

With Xenett, you can save time on data cleanup and focus on more important tasks.

Let me show you how Xenett can make your job easier and help you close your financials more efficiently.

Xenett proves to be super helpful when working with Quickbooks.

How?

So, Xenett is an accounting workflow and financial close management software that is designed to work seamlessly with QBO.

It acts as a smart add-on for you that integrates directly with your QBO account.

Why Use Xenett with QBO?

Here are some reasons why Xenett can be a valuable addition to your QBO experience:

- Enhanced Accuracy: Xenett automatically detects errors and inconsistencies in your QBO data, helping you to avoid mistakes and ensuring your financials are accurate.

- A simplified Workflow: Xenett automates repetitive tasks and simplifies the review process for tasks like categorizing transactions and identifying missing information. This can save you significant time and effort.

Smart Search Feature - Xenett - YouTube

- Improved Collaboration: If you're an accountant or bookkeeper, Xenett facilitates communication with your clients. You can easily flag discrepancies or missing information within QBO for them to address.

- Faster Month-End Close: Xenett's features can significantly speed up the process of closing your books in QBO at the end of each month.

Key Benefits of using Xenett:

- Reduced Errors: It minimizes mistakes in your QBO data with automated error detection.

- Saved Time: It automates tasks and simplifies workflows, freeing up your time for other priorities.

- Faster Financial Close: It Improves the month-end closing process in QBO.

In essence, Xenett acts like a supercharged assistant for your QBO account, helping you maintain accurate books, save time, and collaborate effectively.

If you're looking to get more out of QBO and improve your accounting efficiency, then Xenett is definitely worth considering.

Tips for Choosing the Right QuickBooks Product

Let's talk about picking the perfect QuickBooks product for your business. Together, we'll go through some key points to help you make the best choice. I’ll guide you step-by-step to ensure you understand everything easily.

Factors to Consider

Business Size and Type:

First, think about the size of your business. Are you a freelancer, running a small business, managing a medium-sized business, or overseeing a large enterprise? Also, identify your industry type. Are you service-based, retail, manufacturing, or something else?

Specific Accounting Needs:

Next, look at your specific accounting needs. Do you just need basic bookkeeping, or do you require advanced features like inventory management and payroll? Consider any special requirements your industry might have, like project costing for construction or POS systems for retail.

Budget:

Lastly, evaluate your budget. How much can you spend on accounting software? Compare the costs of different QuickBooks versions, whether it’s a subscription fee or a one-time purchase.

Recommendations

For Freelancers and Self-Employed Individuals:

QuickBooks Self-Employed:

- Why: This version is great if you need to track income and expenses, manage invoices, and prepare for taxes.

- Features: Expense tracking, mileage tracking, simple invoicing, and tax estimation.

For Small Businesses with Basic Needs:

QuickBooks Online Simple Start:

- Why: Perfect if you need basic accounting features.

- Features: Income and expense tracking, invoicing, tax preparation, and reporting.

For Growing Small to Medium-Sized Businesses:

QuickBooks Online Essentials:

- Why: Suitable if you need to manage bills, track time, and handle multiple currencies.

- Features: Bill management, time tracking, and multi-currency support.

For Medium to Large-Sized Businesses:

QuickBooks Online Plus:

- Why: Best for managing advanced inventory and tracking project profitability.

- Features: Inventory tracking, project profitability, bill management, and class tracking.

For Larger Enterprises with Complex Needs:

QuickBooks Enterprise:

- Why: Designed for large businesses needing robust accounting, inventory management, and advanced reporting.

- Features: Advanced inventory management, user permissions, customizable reporting, and scalability.

For Businesses Needing Payroll Services:

QuickBooks Payroll (integrated with QuickBooks Online or Desktop):

- Why: Ideal for automating payroll processing, calculating taxes, and managing employee benefits.

- Features: Automated payroll, tax calculations, direct deposit, and employee benefits management.

For Mac Users:

QuickBooks Mac:

- Why: Optimised for small businesses using Mac OS, offering a robust set of accounting features.

- Features: Bank reconciliation, customizable invoices, expense tracking, and integration with Mac-specific features.

For Businesses with Complex Time Tracking Needs:

QuickBooks Time (formerly TSheets):

- Why: Suitable for businesses needing detailed time tracking for payroll and project management.

- Features: Employee time tracking, GPS tracking, scheduling, and integration with QuickBooks for payroll.

By considering these factors and tailored recommendations, you can choose the right QuickBooks product that fits your unique needs. This will help ensure efficient financial management and streamlined operations for your business.

Final Say

In conclusion, QuickBooks is more than just a tool—it's a powerful way to manage your business finances.

But there’s something that can make it even better: Xenett. Here’s why you should think about using Xenett with QuickBooks.

Quick Recap:

What is QuickBooks?

- It's easy-to-use software that helps with bookkeeping, invoicing, payroll, and taxes for small to medium businesses, accounting agencies and freelancers.

Top Features:

- You can use it on your phone, get real-time updates, make custom reports, and store everything in the cloud.

Different Versions:

- QuickBooks Online, Self-Employed, Desktop, Payroll, Mac, and Time. There’s one for every need!

What Do Users Say?

- People love how easy it is to use and the great integrations. Some have had issues with customer support, but overall, it’s a hit.

Pricing:

- Flexible plans to fit all budgets, from freelancers to accounting agencies to big businesses.

Making QuickBooks Even Better

Now, let’s talk about Xenett. It’s like an upgrade for your QuickBooks.

Why Use Xenett?

- Better Accuracy: Finds and fixes mistakes automatically.

- Simpler Workflow: Automates boring tasks, saving you time.

- Improved Collaboration: Helps accountants and bookkeepers work better with clients.

- Faster Month-End Close: Speeds up the process of closing your books each month.

So, Are You Ready to Get Started?

By using QuickBooks with Xenett, you’ll make your financial management even better. It’s simple, accurate, and saves you time.

Try QuickBooks and Xenett today and see how your business can benefit. 🌟

Questions You Might Have

Yes, it can! Think of Xenett as a helpful assistant that makes everything easier.

Xenett finds and corrects errors in your QuickBooks data, so your books are always correct.

Absolutely! By automating tasks, Xenett lets you focus on what’s important.

Yes, especially if you’re an accountant or bookkeeper. It makes client communication easy.

.webp)

.svg)